Business, 22.04.2020 03:31 chicapunk1736

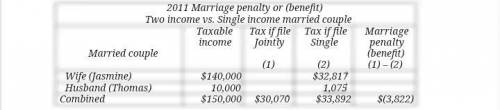

In 2019, Jasmine and Thomas, a married couple, had taxable income of $150,000. If they were to file separate tax returns, Jasmine would have reported taxable income of $140,000 and Thomas would have reported taxable income of $10,000. Use Tax Rate

Answers: 3

Another question on Business

Business, 22.06.2019 12:40

When cell phones were first entering the market, they were relatively large and reception was undependable. all cell phones were essentially the same. but as the technology developed, many competitors entered, introducing features unique to their phones. today, cell phones are only a small fraction of the size and weight of their predecessors. consumers can buy cell phones with color screens, cameras, internet access, daily planners, or voice activation (and any combination of these features). the history of the cell phone demonstrates what marketing trend?

Answers: 3

Business, 22.06.2019 14:20

In canada, the reference base period for the cpi is 2002. by 2012, prices had risen by 21.6 percent since the base period. the inflation rate in canada in 2013 was 1.1 percent. calculate the cpi in canada in 2013. hint: use the information that “prices had risen by 21.6 percent since the base period” to find the cpi in 2012. use the inflation rate formula (inflation is the growth rate of the cpi) to find cpi in 2013, knowing the cpi in 2012 and the inflation rate. the cpi in canada in 2013 is round up your answer to the first decimal. 122.9 130.7 119.6 110.5

Answers: 1

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

Business, 22.06.2019 23:10

Mr. pines is considering buying a house and renting it to students. the yearly operating costs are $1,900. the house can be sold for $175,000 at the end of 10 years and it is considered 18% to be a suitable annual effective interest rate. if the house costs $100,000 to purchase, how much would you need to charge your tenants each year in rent? (assume a single payment for the years rent at the end of each year)

Answers: 1

You know the right answer?

In 2019, Jasmine and Thomas, a married couple, had taxable income of $150,000. If they were to file...

Questions

English, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Biology, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

English, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Geography, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01