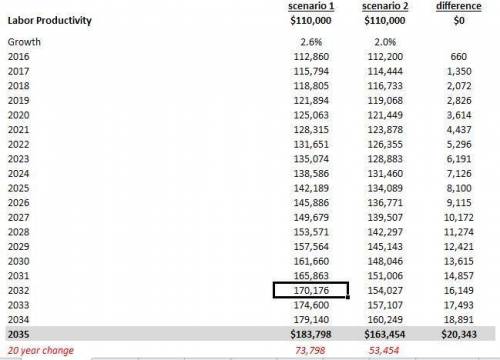

Suppose labor productivity is $110,000 per worker in 2015. Calculate the value of labor productivity in 2035 (20 years later) if: Instructions: Enter your responses rounded to the closest $100. a. Productivity continues to grow by 2.6 percent per year. U. S labor productivity in 2035 would be $ 183,798 183,798 Correct per worker. b. Productivity falls to 2.0 percent per year (the average productivity growth between 1970 and 2009). U. S. labor productivity in 2035 would be $ 163,454 163,454 Correct per worker. c. How much lager would labor productivity per worker be in 2035 with the higher growth rate compared to the lower growth rate. Instructions: Enter your responses rounded to two decimal places. 1.12

Answers: 2

Another question on Business

Business, 21.06.2019 21:40

Morgana company identifies three activities in its manufacturing process: machine setups, machining, and inspections. estimated annual overhead cost for each activity is $168,000, $315,900, an $97,200, respectively. the cost driver for each activity and the expected annual usage are number of setups 2,100, machine hours 24,300, and number of inspections 1,800. compute the overhead rate for each activity. machine setups $ per setup machining $ per machine hour inspections $ per inspection

Answers: 1

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 11:40

Select the correct answer. which is a benefit of planning for your future career? a.being less prepared after high school. b.having higher tuition in college. c.earning college credits in high school. d.ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 17:30

Kevin and jenny, who are both working full-time, have three children all under the age of ten. the two youngest children, who are three and five years old, attended eastside pre-school for a total cost of $3,000. ervin, who is nine, attended big kid daycare after school at a cost of $2,000. jenny has earned income of $15,000 and kevin earns $14,000. what amount of childcare expenses should be used to determine the child and dependent care credit?

Answers: 3

You know the right answer?

Suppose labor productivity is $110,000 per worker in 2015. Calculate the value of labor productivity...

Questions

Health, 20.08.2019 03:50

Mathematics, 20.08.2019 03:50

English, 20.08.2019 03:50

Biology, 20.08.2019 03:50

Mathematics, 20.08.2019 03:50

History, 20.08.2019 03:50

Computers and Technology, 20.08.2019 03:50

Mathematics, 20.08.2019 03:50

Chemistry, 20.08.2019 03:50

Biology, 20.08.2019 03:50

Mathematics, 20.08.2019 03:50

Mathematics, 20.08.2019 03:50

English, 20.08.2019 03:50

Mathematics, 20.08.2019 03:50

History, 20.08.2019 03:50

Mathematics, 20.08.2019 03:50