Professor John Morton has just been appointed chairperson of the Finance Department at Westland University. In reviewing the department’s cost records, Professor Morton has found the following total cost associated with Finance 101 over the last several terms:

Term Number of

Sections Offered Total

Cost

Fall, last year 7 $ 13,500

Winter, last year 3 $ 8,000

Summer, last year 6 $ 12,000

Fall, this year 2 $ 6,500

Winter, this year 4 $ 10,000

Professor Morton knows that there are some variable costs, such as amounts paid to graduate assistants, associated with the course. He would like to have the variable and fixed costs separated for planning purposes.

Required:

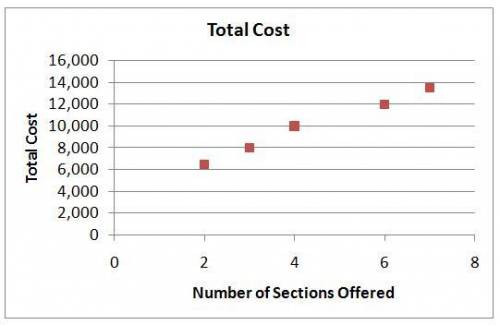

1. Prepare a scattergraph plot. (Place total cost on the vertical axis and number of sections offered on the horizontal axis.)

Instructions:

1. On the graph below, use the point tool (Fall last year) to plot number of sections offered on the horizontal axis and total cost on the vertical axis.

2. Repeat the same process for the plotter tools (winter last year to winter this year).

3. To enter exact coordinates, click on the point and enter the values of x and y.

4. To remove a point from the graph, click on the point and select delete option.

2(a). Using the least-squares regression method, estimate the variable cost per section and the total fixed cost per term for Finance 101. (Round your fixed cost and variable cost to nearest whole dollars.)

2(b). Express these estimates in the linear equation form Y = a + bX. (Round your fixed cost and variable cost to nearest whole dollars.)

3a. Assume that because of the small number of sections offered during the Winter Term this year, Professor Morton will have to offer ten sections of Finance 101 during the Fall Term. Compute the expected total cost for Finance 101. (Do not round your intermediate calculations. Round your final answer to nearest whole dollar.)

Answers: 2

Another question on Business

Business, 21.06.2019 17:10

At the beginning of the accounting period, nutrition incorporated estimated that total fixed overhead cost would be $50,600 and that sales volume would be 10,000 units. at the end of the accounting period actual fixed overhead was $56,100 and actual sales volume was 11,000 units. nutrition uses a predetermined overhead rate and a cost plus pricing model to establish its sales price. based on this information the overhead spending variance is multiple choice $5,500 favorable. $440 favorable. $5,500 unfavorable. $440 unfavorable.

Answers: 3

Business, 22.06.2019 05:30

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

You know the right answer?

Professor John Morton has just been appointed chairperson of the Finance Department at Westland Univ...

Questions

Social Studies, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Social Studies, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

History, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00

Mathematics, 08.01.2022 14:00