Business, 24.04.2020 22:02 jackieanguiano3700

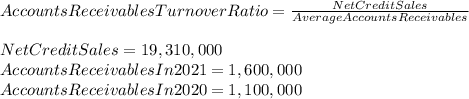

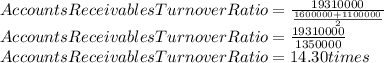

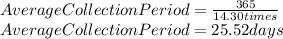

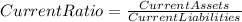

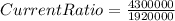

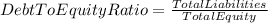

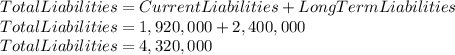

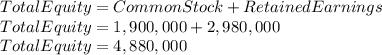

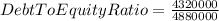

The 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000, and net income of $1,700,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 700,000 $ 860,000 Accounts receivable 1,600,000 1,100,000 Inventory 2,000,000 1,500,000 Long-term assets 4,900,000 4,340,000 Total assets $ 9,200,000 $ 7,800,000 Liabilities and Stockholders' Equity Current liabilities $ 1,920,000 $ 1,760,000 Long-term liabilities 2,400,000 2,500,000 Common stock 1,900,000 1,900,000 Retained earnings 2,980,000 1,640,000 Total liabilities and stockholders' equity $ 9,200,000 $ 7,800,000 Industry averages for the following four risk ratios are as follows: Average collection period 25 days Average days in inventory 60 days Current ratio 2 to 1 Debt to equity ratio 50% Required: 1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.) 2. Do you think the company is more risky or less risky than the industry average

Answers: 1

Another question on Business

Business, 22.06.2019 07:10

Refer to the payoff matrix. suppose that speedy bike and power bike are the only two bicycle manufacturing firms serving the market. both can choose large or small advertising budgets. is there a nash equilibrium solution to this game?

Answers: 1

Business, 22.06.2019 10:00

University car wash built a deluxe car wash across the street from campus. the new machines cost $219,000 including installation. the company estimates that the equipment will have a residual value of $19,500. university car wash also estimates it will use the machine for six years or about 12,500 total hours. actual use per year was as follows: year hours used 1 3,100 2 1,100 3 1,200 4 2,800 5 2,600 6 1,200 prepare a depreciation schedule for six years using the following methods: 1. straight-line. 2. double-declining-balance. 3. activity-based.

Answers: 1

Business, 22.06.2019 11:10

Your team has identified the risks on the project and determined their risk score. the team is in the midst of determining what strategies to put in place should the risks occur. after some discussion, the team members have determined that the risk of losing their network administrator is a risk they'll just deal with if and when it occurs. although they think it's a possibility and the impact would be significant, they've decided to simply deal with it after the fact. which of the following is true regarding this question? a. this is a positive response strategy.b. this is a negative response strategy.c. this is a response strategy for either positive or negative risk known as contingency planning.d. this is a response strategy for either positive or negative risks known as passive acceptance.

Answers: 2

Business, 22.06.2019 19:10

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

You know the right answer?

The 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,...

Questions

Mathematics, 07.07.2020 14:01

Physics, 07.07.2020 14:01

Mathematics, 07.07.2020 14:01

Physics, 07.07.2020 14:01

Engineering, 07.07.2020 15:01

Mathematics, 07.07.2020 15:01

Biology, 07.07.2020 15:01

Mathematics, 07.07.2020 15:01

%

%