Business, 25.04.2020 04:48 frankgore8496

The following selected transactions are from King Company.

Year 1

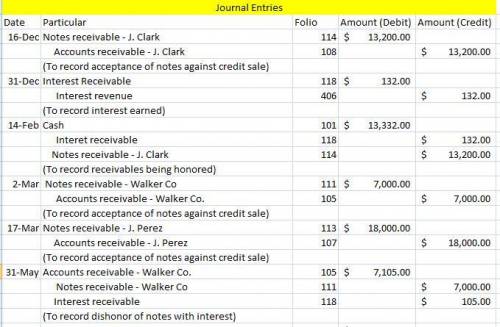

Dec. 16 Accepted a $13,200, 60-day, 12% note in granting Jean Clark a time extension on his past-due account receivable.

31 Made an adjusting entry to record the accrued interest on the Clark note.

Year 2

Feb. 14 Received Clark’s payment of principal and interest on the note dated December 16.

Mar. 2 Accepted a $7,000, 6%, 90-day note in granting a time extension on the past-due account receivable from Walker Co.

17 Accepted a $18,000, 30-day, 7% note in granting Juan Perez a time extension on her past-due account receivable.

Apr. 16 Perez dishonored her note.

May 31 Walker Co. dishonored its note.

Aug. 7 Accepted a $16,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Taylor Co.

Sep. 3 Accepted a $17,400, 60-day, 10% note in granting Tony Turner a time extension on his past-due account receivable.

Nov. 2 Received payment of principal plus interest from Turner for the September 3 note.

Nov. 5 Received payment of principal plus interest from Taylor for the August 7 note.

Dec. 1

Wrote off the Perez account against the Allowance for Doubtful Accounts.

2) March 2 Mar. 2 Accepted an $7,000, 6%, 90-day note in granting a time extension on the past-due account receivable from Walker Co.

3) Mar. 17 Accepted a $18,000, 30-day, 7% note in granting Juan Perez a time extension on her past-due account receivable.

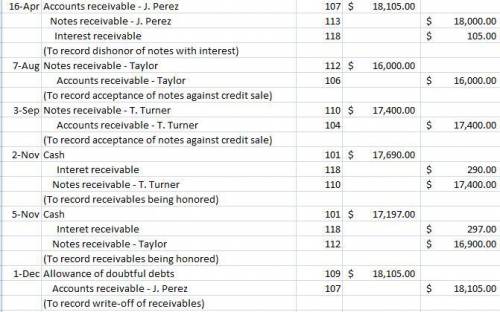

4) April 16 Apr. 16 Perez dishonored her note.

5) May 31 Walker Co. dishonored its note.

6) Aug. 7 Accepted a(n) $16,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Taylor Co.

7) Sept. 3 Accepted a $17,400, 60-day, 10% note in granting Tony Turner a time extension on his past-due account receivable.

8) Nov. 2 Received payment of principal plus interest from Turner for the September 3 note.

9) Nov. 5 Received payment of principal plus interest from Taylor for the August 7 note.

10) Dec. 1 Wrote off the Perez account against Allowance for Doubtful Accounts. No additional interest was accrued.

Options for General Journal

000: No journal entry required

101: Cash

103: Account receivable - Other

104: Accounts receivable - T. Turner

105: Accounts receivable - Walker Co.

106: Accounts receivable - Taylor

107: Accounts receivable - J. Perez

108: Accounts receivable - J. Clark

109: Allowance for doubtful accounts

110: Notes receivable - T. Turner

111: Notes receivable - Walker Co.

112: Notes receivable - Taylor

113: Notes receivable - J. Perez

114: Notes receivable - J. Clark

118: Interest receivable

120: Merchandise inventory

201: Accounts payable - T. Turner

202: Accounts payable - Walker Co.

203: Accounts payable - Taylor

204: Accounts payable - J. Clark

209: Salaries payable

226: Unearned fees

301: Owner's Capital

302: Owner's withdrawals

403: Sales

404: Sales returns and allowances

405: Sales discounts

406: Interest revenue

600: Cost of goods sold

602: Purchases

603: Purchases returns and allowances

604: Purchases discounts

640: Rent expense

652: Freight-in

655: Bad debts expense

660: Delivery expense

665: Interest expense

700: Income summary

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

As a group is leaving, you ask them if they had a good experience at the restaurant. they mention that they had poor service and their food was cold. a.apologize and ask them to give the restaurant another chance in the future. you tell them that guests usually have a great experience here. b.apologize then ask for the server’s name and immediately notify the manager after they leave. c.apologize for the bad experience and ask them to wait as you call the manager to talk to them. d.apologize for the bad experience and encourage them to complete the customer service survey. this feedback will ensure other guests do not have the same experience.

Answers: 2

Business, 22.06.2019 03:30

Joe finally found a house for sale that he liked. which factor could increase the price of the house he likes? a. both he and the seller each have a real estate agent. b. a home inspector finds faulty wiring in the house. c. the house has been for sale for almost a year. d. several buyers all want that same house.

Answers: 2

Business, 22.06.2019 20:00

Acompetitive market in healthcare would a. overprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers b. underprovide healthcare because it would eliminate medicare and medicaid c. underprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers d. overprovide healthcare because it would be similar to the approach used in canada

Answers: 1

Business, 22.06.2019 23:50

Harris fabrics computes its predetermined overhead rate annually on the basis of direct labor-hours. at the beginning of the year, it estimated that 34,000 direct labor-hours would be required for the period’s estimated level of production. the company also estimated $599,000 of fixed manufacturing overhead expenses for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. harris's actual manufacturing overhead for the year was $768,234 and its actual total direct labor was 34,500 hours.required: compute the company's predetermined overhead rate for the year. (round your answer to 2 decimal places.)

Answers: 2

You know the right answer?

The following selected transactions are from King Company.

Year 1

Dec. 16...

Year 1

Dec. 16...

Questions

Mathematics, 25.02.2021 01:30

Mathematics, 25.02.2021 01:30

History, 25.02.2021 01:30

Biology, 25.02.2021 01:30

History, 25.02.2021 01:30

Mathematics, 25.02.2021 01:30

History, 25.02.2021 01:30

History, 25.02.2021 01:30

Mathematics, 25.02.2021 01:30

History, 25.02.2021 01:30

English, 25.02.2021 01:30

Mathematics, 25.02.2021 01:30