Business, 25.04.2020 04:53 cynthiauzoma367

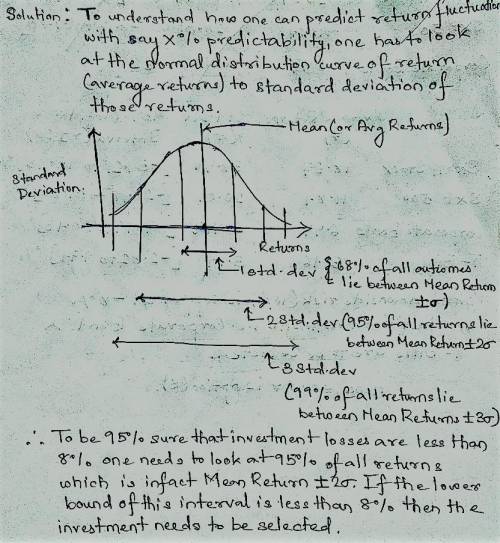

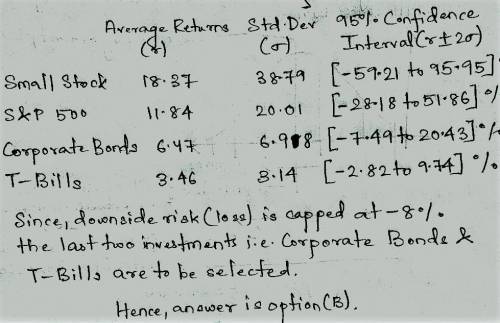

You are choosing between these four investments and you want to be 95% certain that you do not lose more than 8.00 % on your investment. Which investments could you choose?

Small Stocks S&P 500 Corporate Bonds T-Bills

Average return 18.37% 11.84% 6.47% 3.46%

Standard Deviation 38.79% 20.01% 6.98% 3.14%

of returns

(Select the best choice below.)

Which of the following have the lower bound of the estimated range greater than

18.00 %?

A. All of the Investments

B. T-Bills only

C. Long-term Government of Canada Bonds and T-Bills

D. S&P TSX and S&P 500 in CAD

E. Long-term Government of Canada Bonds and S&P 500 in CAD

Answers: 1

Another question on Business

Business, 22.06.2019 05:10

Suppose that the free states of eldricia, a small nation, has consumption, investment, government purchases, imports, and exports as follows. consumption $140 investment $50 government purchases $45 imports $30 exports $15 calculate the free states of eldricia's gdp

Answers: 2

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

Business, 22.06.2019 11:40

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x,y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

Business, 22.06.2019 20:30

The research of robert siegler and eric jenkins on the development of the counting-on strategy is an example of design.

Answers: 3

You know the right answer?

You are choosing between these four investments and you want to be 95% certain that you do not lose...

Questions

History, 29.01.2020 18:00

Mathematics, 29.01.2020 18:00

Mathematics, 29.01.2020 18:00

Spanish, 29.01.2020 18:00

Computers and Technology, 29.01.2020 18:00

Mathematics, 29.01.2020 18:00

English, 29.01.2020 18:00

Biology, 29.01.2020 18:00

History, 29.01.2020 18:00

Mathematics, 29.01.2020 18:00