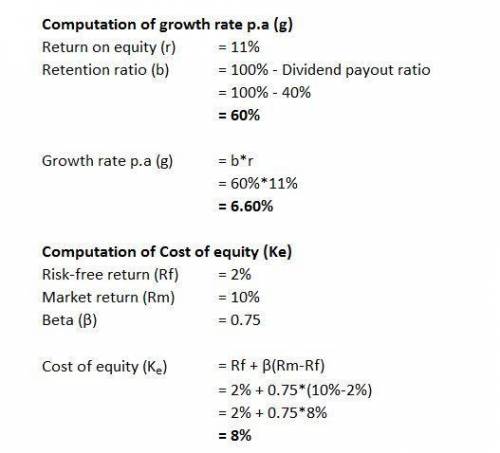

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, currently has a dividend payout ratio of 40%. Its beta is 0.75 and its current dividend per share is $1.44 per year. Suppose YUCK has a return on equity of 11% and the risk-free rate is 2% while the expected annual return on the S&P 500 is 10%.

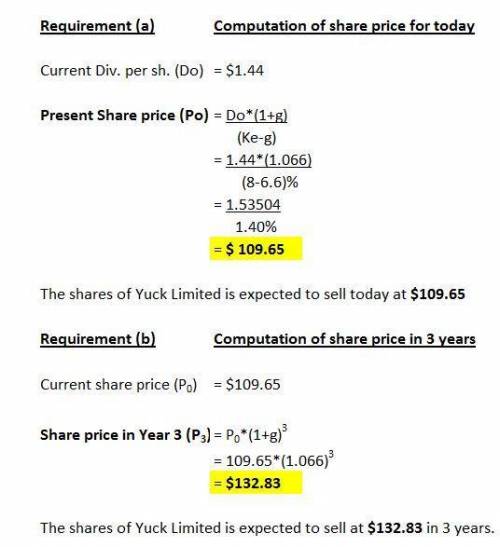

(a) At what price do you expect a share of YUCK to sell for today?

(b) At what price do you expect YUCK to sell in three years?

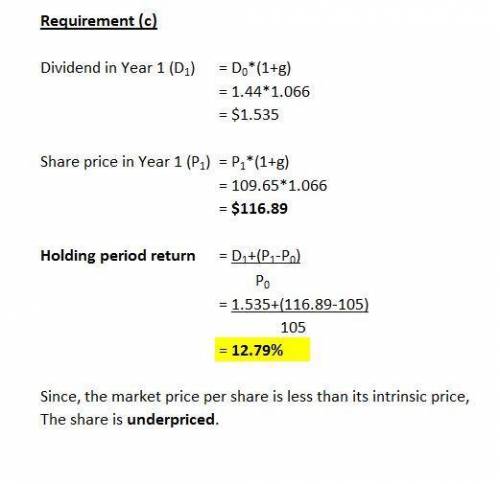

(c) It turns out that YUCK currently sells for $105. If you expect that YUCK’s market price will equal its intrinsic value 1 year from now, what is your expected 1 year holding period return on YUCK stock? What does this imply about under/overpricing and alphas?

Answers: 2

Another question on Business

Business, 21.06.2019 13:00

Among the advantages of corporations are the ease of raising financial capital, professional management, and a. rapid promotions b. lower taxes c. limited liability d. specialization

Answers: 1

Business, 22.06.2019 02:30

Atax on the sellers of coffee will a. increase the price of coffee paid by buyers, increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. b. increase the price of coffee paid by buyers, increase the e ffective price of coffee received by sellers, and decrease the equilibrium quantity of coffee. c. increase the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. d. increa se the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

Answers: 3

Business, 22.06.2019 02:30

Consider the local telephone company, a natural monopoly. the following graph shows the monthly demand curve for phone services and the company’s marginal revenue (mr), marginal cost (mc), and average total cost (atc) curves. 0 2 4 6 8 10 12 14 16 18 20 100 90 80 70 60 50 40 30 20 10 0 price (dollars per subscription) quantity (thousands of subscriptions) d mr mc atc 8, 60 suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints. complete the first row of the following table. pricing mechanism short run long-run decision quantity price profit (subscriptions) (dollars per subscription) profit maximization marginal-cost pricing average-cost pricing suppose that the government forces the monopolist to set the price equal to marginal cost. complete the second row of the previous table. suppose that the government forces the monopolist to set the price equal to average total cost. complete the third row of the previous table. under average-cost pricing, the government will raise the price of output whenever a firm’s costs increase, and lower the price whenever a firm’s costs decrease. over time, under the average-cost pricing policy, what will the local telephone company most likely do

Answers: 2

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

You know the right answer?

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, curre...

Questions

History, 12.05.2021 17:10

Mathematics, 12.05.2021 17:10

Geography, 12.05.2021 17:20

Mathematics, 12.05.2021 17:20

Mathematics, 12.05.2021 17:20

Mathematics, 12.05.2021 17:20

Computers and Technology, 12.05.2021 17:20

Mathematics, 12.05.2021 17:20

Social Studies, 12.05.2021 17:20

English, 12.05.2021 17:20

Law, 12.05.2021 17:20

English, 12.05.2021 17:20

Mathematics, 12.05.2021 17:20

Mathematics, 12.05.2021 17:20

Mathematics, 12.05.2021 17:20