Business, 06.05.2020 07:38 officialgraciela67

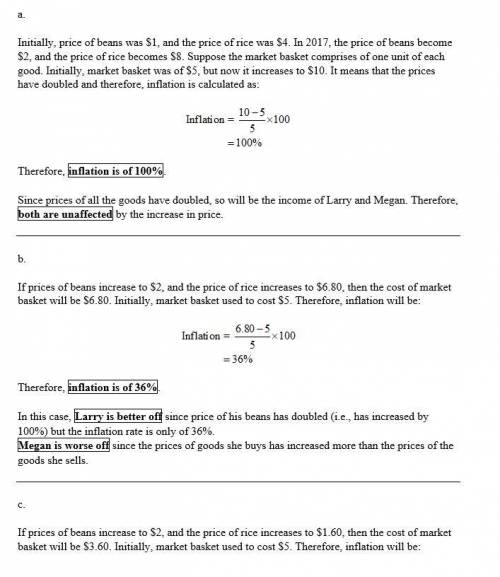

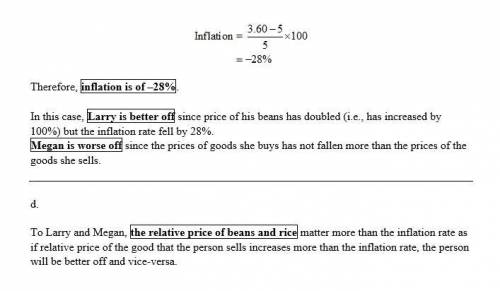

Consider the effects of inflation in an economy composed of only two people: Larry, a bean farmer, and Megan, a rice farmer. Larry and Megan both always consume equal amounts of rice and beans. In 2016 the price of beans was $1, and the price of rice was $4.Suppose that in 2017 the price of beans was $2 and the price of rice was $8.Inflation was. Indicate whether Larry and Megan were better off, worse off, or unaffected by the changes in prices. Better OffWorse OffUnaffectedLarry Megan Now suppose that in 2017 the price of beans was $2 and the price of rice was $4.80.In this case, inflation was. Indicate whether Larry and Megan were better off, worse off, or unaffected by the changes in prices. Better OffWorse OffUnaffectedLarry Megan Now suppose that in 2017, the price of beans was $2 and the price of rice was $1.60.In this case, inflation was. Indicate whether Larry and Megan were better off, worse off, or unaffected by the changes in prices. Better OffWorse OffUnaffectedLarry Megan What matters more to Larry and Megan?The relative price of rice and beansThe overall inflation rate

Answers: 1

Another question on Business

Business, 22.06.2019 05:50

Which is one solution to levy the complexity of the global matrix strategy with added customer-focused dimensions?

Answers: 3

Business, 22.06.2019 06:00

Why might a business based on a fad be a good idea? question 2 options: fads bring in the most customers. some fads are longer lasting than expected. fads have made some business owners incredibly wealthy. fads can take a business in a new direction.

Answers: 2

Business, 22.06.2019 10:10

Karen is working on classifying all her company’s products in terms of whether they have strong or weak market share and whether this share is in a slow or growing market. what type of strategic framework is she using?

Answers: 2

Business, 22.06.2019 11:20

Camilo is a self-employed roofer. he reported a profit of $30,000 on his schedule c. he had other taxable income of $5,000. he paid $3,000 for hospitalization insurance. his self-employment tax was $4,656. he paid his former wife $4,000 in court-ordered alimony and $4,000 in child support. what is the amount camilo can deduct in arriving at adjusted gross income (agi)?

Answers: 2

You know the right answer?

Consider the effects of inflation in an economy composed of only two people: Larry, a bean farmer, a...

Questions

Mathematics, 28.05.2020 08:00

Chemistry, 28.05.2020 08:00

Mathematics, 28.05.2020 08:00

Mathematics, 28.05.2020 08:00

Mathematics, 28.05.2020 08:00

Mathematics, 28.05.2020 08:00

English, 28.05.2020 08:00

History, 28.05.2020 08:00

Mathematics, 28.05.2020 08:00

English, 28.05.2020 08:00

History, 28.05.2020 08:00