Business, 06.05.2020 06:20 janayshas84

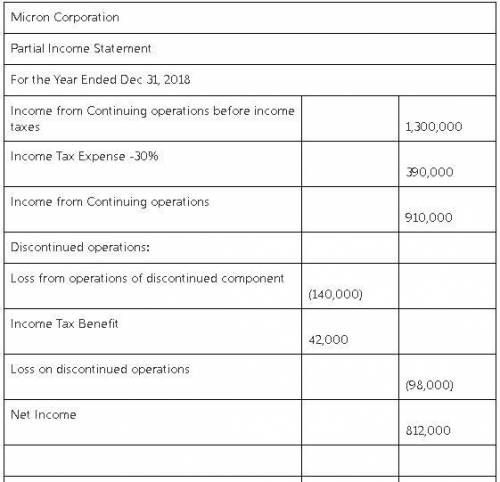

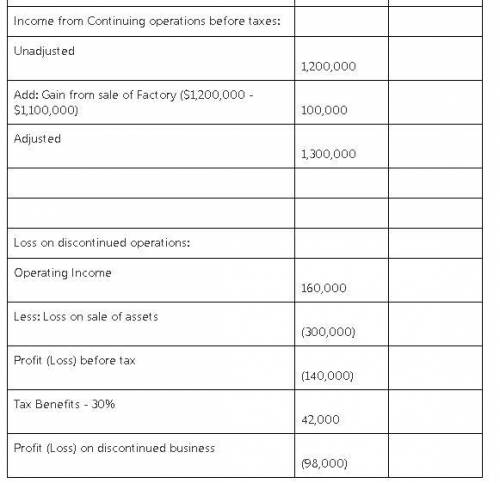

For the year ending December 31, 2018, Micron Corporation had income from continuing operations before taxes of $1,200,000 before considering the following transactions and events. All of the items described below are before taxes and the amounts should be considered material.1. In November 2018, Micron sold its Waffle House restaurant chain that qualified as a component of an entity. The company had adopted a plan to sell the chain in May 2018. The income from operations of the chain from January 1, 2018, through November was $160,000 and the loss on sale of the chain’s assets was $300,000.In 2018, Micron sold one of its six factories for $1,200,000. At the time of the sale, the factory had a book value of $1,100,000. The factory was not considered a component of the entity.2. In 2016, Micron’s accountant omitted the annual adjustment for patent amortization expense of $120,000. The error was not discovered until December 2018.Required:.Prepare Micron’s income statement, beginning with income from continuing operations before taxes, for the year ended December 31, 2018. Assume an income tax rate of 30%. Ignore EPS disclosures. (Amounts to be deducted should be indicated with a minus sign. MICRON CORPORATION Partial Income Statement For the Year Ended December 31, 2018Income from continuing operations before income taxes Income tax benefit Income from continuing operations Discontinued operations: Loss from operations of discontinued component Income tax benefit Loss on discontinued operations

Answers: 1

Another question on Business

Business, 22.06.2019 06:40

At april 1, 2019, the food and drug administration is in the process of investigating allegations of false marketing claims by hulkly muscle supplements. the fda has not yet proposed a penalty assessment. hulkly’s fiscal year ends on december 31, 2018. the company’s financial statements are issued in april 2019. required: for each of the following scenarios, determine the appropriate way to report the situation. 1. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 2. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is probable. 3. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 4. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is probable.

Answers: 1

Business, 22.06.2019 10:00

In a small group, members have taken on the task roles of information giver, critic/analyzer, and recorder, and the maintenance roles of gatekeeper and follower. they need to fulfill one more role. which of the following would be most effective for their group dynamics? a dominator b coordinator c opinion seeker d harmonizer

Answers: 1

Business, 22.06.2019 11:30

When the amount for land is 36,000 and the amount paid for expenses is 10,000, the balance of total asset is

Answers: 2

Business, 22.06.2019 13:50

Suppose portugal has 700 workers and 26,000 units of capital, and france has 18,000 workers and 700 units of capital. technology is identical in both countries. assume that wine is the capital-intensive good and cloth is the labor-intensive good. which of the following statements is correct if the nations start trading with each other? a) wages will increase in portugal.b) rental rates in france will increase.c) wages in france will decrease.d) rental rates in portugal will increase.

Answers: 2

You know the right answer?

For the year ending December 31, 2018, Micron Corporation had income from continuing operations befo...

Questions

Mathematics, 19.02.2020 00:19

Mathematics, 19.02.2020 00:19

History, 19.02.2020 00:19

English, 19.02.2020 00:19

Mathematics, 19.02.2020 00:20