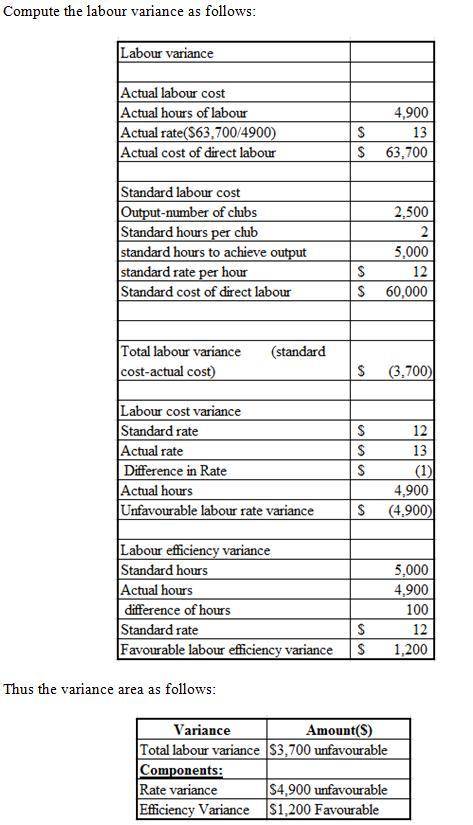

Custom Clubs produces handmade golf clubs. The process is labor intensive. The speed at which a club can be built depends on the skill level of the individual worker. Management has established a standard of 2 labor hours per club. The standard wage rate is $12 per hour. During a recent month, 2,500 custom clubs were produced. Management was pleased that only 4,900 labor hours were worked; however, total wages amounted to $63,700.Compute the total variance for labor, and determine how much is related to rate and efficiency components. Labor variances: Actual Labor Cost Actual hours of labor - Actual rate $ - Actual cost of direct labor $ - Standard Labor Cost Output - number of clubs - Standard hours per club $ - Standard hours to achieve output - Standard rate per hour $ - Standard cost of direct labor $ - Total labor variance (standard cost v. actual cost) $ - Labor rate variance: Standard rate $ - Actual rate - $ - Actual hours - Unfavorable labor rate variance $ - Labor efficiency variance: Standard hours - Actual hours - - Standard rate $ - Favorable labor efficiency variance $

Answers: 3

Another question on Business

Business, 22.06.2019 00:40

Guardian inc. is trying to develop an asset-financing plan. the firm has $450,000 in temporary current assets and $350,000 in permanent current assets. guardian also has $550,000 in fixed assets. assume a tax rate of 40 percent. a. construct two alternative financing plans for guardian. one of the plans should be conservative, with 70 percent of assets financed by long-term sources, and the other should be aggressive, with only 56.25 percent of assets financed by long-term sources. the current interest rate is 12 percent on long-term funds and 7 percent on short-term financing. compute the annual interest payments under each plan.

Answers: 3

Business, 22.06.2019 12:20

Consider 8.5 percent swiss franc/u.s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 14:30

Your own record of all your transactions. a. check register b. account statement

Answers: 1

You know the right answer?

Custom Clubs produces handmade golf clubs. The process is labor intensive. The speed at which a club...

Questions

Mathematics, 18.11.2020 20:00

Mathematics, 18.11.2020 20:00

Biology, 18.11.2020 20:00

Biology, 18.11.2020 20:00

Biology, 18.11.2020 20:00

Physics, 18.11.2020 20:00

Mathematics, 18.11.2020 20:00

Chemistry, 18.11.2020 20:00

Mathematics, 18.11.2020 20:00

Mathematics, 18.11.2020 20:00

Mathematics, 18.11.2020 20:00

Mathematics, 18.11.2020 20:00