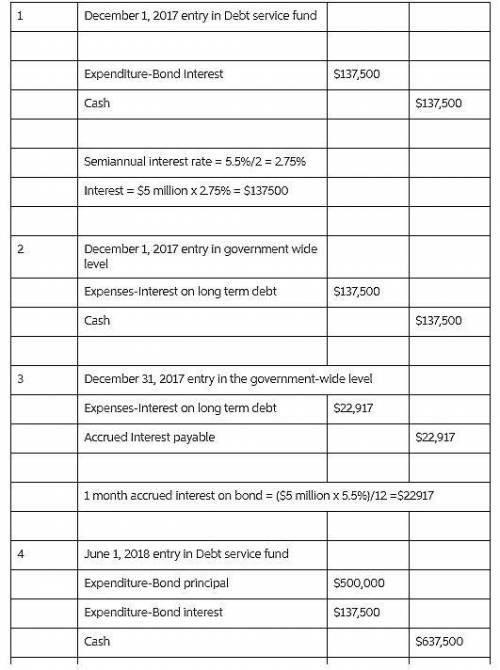

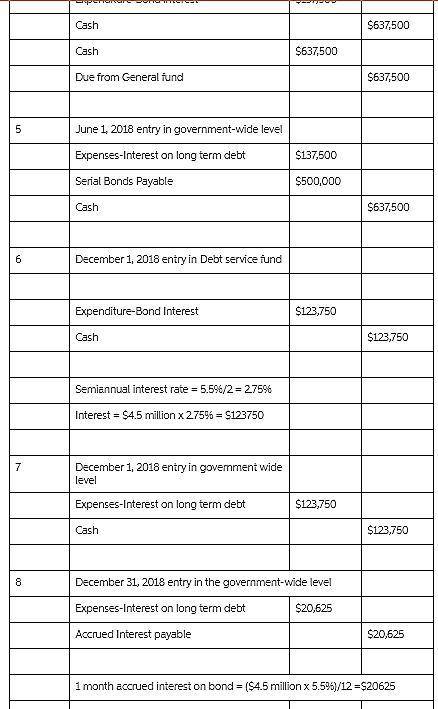

On June 1, 2019, the City of Allentown, PA issued at par, a ten-year, 5.5%, $5,000,000 in serial bonds, with interest payable semi-annually on June 1 and December 1. In addition, the bonds will mature in equal installments every June 1 over the term of the bond. The City of Allentown has a fiscal year end at December 31.

Required:

1. Journalize the following bond transactions both in the Debt Services Fund and at the government-wide (Governmental Activities) level. To receive credit, show all of your calculations in good form. Round all amounts to the nearest dollar.

a. December 1, 2019 entry in the Debt Services Fund:

b. December 1, 2019 entry in the government-wide (Governmental Activities) level:

c. December 31, 2019 entry in the government-wide (Governmental Activities) level:

d. June 1, 2020 entry in the Debt Services Fund:

e. June 1, 2020 entry in the government-wide (Governmental Activities) level:

f. December 1, 2020 entry in the Debt Services Fund:

g. December 1, 2020 entry in the government-wide (Governmental Activities) level:

h. December 31, 2020 entry in the government-wide (Governmental Activities) level:

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

Benton company (bc), a calendar year entity, has one owner, who is in the 37% federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). bc's gross income is $395,000, and its ordinary trade or business deductions are $245,000. ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. if required, round computations to the nearest dollar. a. bc is operated as a proprietorship, and the owner withdraws $100,000 for personal use. bc's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ . b. bc is operated as a c corporation, pays out $100,000 as salary, and pays no dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . the shareholder's tax liability is $ . c. bc is operated as a c corporation and pays out no salary or dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . d. bc is operated as a c corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends. bc's taxable income for the current year is $ , and bc's tax liability is $ .

Answers: 2

Business, 22.06.2019 03:00

Match the given situations to the type of risks that a business may face while taking credit.(there's not just one answer)1. beta ltd. had taken a loan from a bankfor a period of 15 years, but its salesare gradually showing a decline.2. alpha ltd. has taken a loan for increasing its production and sales,but it has not conducted any researchbefore making this decision.3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession.4. delphi ltd. has taken a short-term loanfrom the bank, but its supply chain logistics are not in place.a. foreign exchange riskb. operational riskc. term of loan riskd. revenue projections risk

Answers: 1

Business, 22.06.2019 09:50

Beck company had the following accounts and balances at the end of the year. what is net income or net loss for the year? cash $ 74 comma 000 accounts payable $12,000 common stock $21,000 dividends $12,000 operating expenses $ 13 comma 000 accounts receivable $ 49 comma 000 inventory $ 47 comma 000 longminusterm notes payable $33,000 revenues $ 91 comma 000 salaries payable $ 30 comma 000

Answers: 1

Business, 22.06.2019 10:50

Jen left a job paying $75,000 per year to start her own florist shop in a building she owns. the market value of the building is $120,000. she pays $35,000 per year for flowers and other supplies, and has a bank account that pays 5 percent interest. what is the economic cost of jen's business?

Answers: 3

You know the right answer?

On June 1, 2019, the City of Allentown, PA issued at par, a ten-year, 5.5%, $5,000,000 in serial bon...

Questions

Mathematics, 13.05.2021 18:20

Mathematics, 13.05.2021 18:20

Arts, 13.05.2021 18:20

Social Studies, 13.05.2021 18:20

English, 13.05.2021 18:20

History, 13.05.2021 18:20

Mathematics, 13.05.2021 18:20

Business, 13.05.2021 18:20

Biology, 13.05.2021 18:20

Mathematics, 13.05.2021 18:20