Business, 06.05.2020 02:11 elizabethajih99

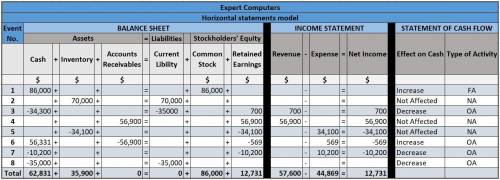

Expert Computers was started in 2018. The company experienced the following accounting events during its first year of operation:

1. Started business when it acquired $86,000 cash from the issue of common stock

2. Purchased merchandise with a list price of $70,000 on account, terms 2/10, n/30

3. Paid off one-half of the accounts payable balance within the discount period

4. Sold merchandise on account for $56,900. Credit terms were 1/20, n/30

5. The merchandise had cost Expert Computers $34,100

6. Collected cash from the account receivable within the discount period

7. Paid $10,200 cash for operating expenses

8. Paid the balance due on accounts payable. The payment was not made within the discount period.

Record the events in a horizontal statements model

Answers: 3

Another question on Business

Business, 22.06.2019 03:20

Yael decides that she no longer enjoys her job, and she quits to open a gluten-free, dairy-free kosher bakery. she pays a monthly rent for her store of $2,000. her labor costs for one month are $4,500, and she spends $6,000 a month on nut flours, sugar, and other supplies. yael was earning $2,500 a month working as a bank teller. these are her only costs. her monthly revenue is $14,000. which of the following statements about yael’s costs and profit are correct? correct answer(s) an accountant would say she is earning a monthly profit of $1,500. her implicit costs are $2,500 a month. an economist would tell her that she is experiencing a loss. her total costs are $12,500 a month. her explicit costs include the labor, rent, and supplies for her store. her economic profit is $1,500 a month.

Answers: 3

Business, 22.06.2019 10:10

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

Business, 22.06.2019 22:10

Afirm plans to begin production of a new small appliance. the manager must decide whether to purchase the motors for the appliance from a vendor at $10 each or to produce them in-house. either of two processes could be used for in-house production; process a would have an annual fixed cost of $200,000 and a variable cost of $7 per unit, and process b would have an annual fixed cost of $175,000 and a variable cost of $8 per unit. determine the range of annual volume for which each of the alternatives would be best. (round your first answer to the nearest whole number. include the indifference value itself in this answer.)

Answers: 2

You know the right answer?

Expert Computers was started in 2018. The company experienced the following accounting events during...

Questions

Physics, 09.09.2021 20:40

Mathematics, 09.09.2021 20:40

Mathematics, 09.09.2021 20:40

History, 09.09.2021 20:40

History, 09.09.2021 20:40

English, 09.09.2021 20:40

Mathematics, 09.09.2021 20:40

Physics, 09.09.2021 20:40

Mathematics, 09.09.2021 20:40

Social Studies, 09.09.2021 20:40

Mathematics, 09.09.2021 20:40