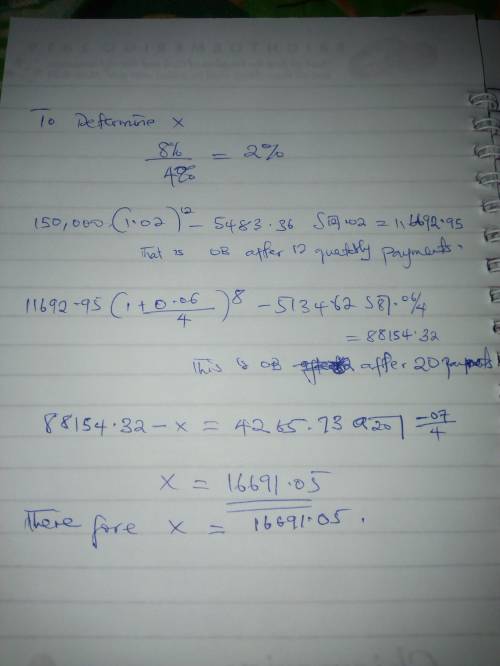

An investor took out a loan of 150,000 at 8% compounded quarterly, to be repaid over 10 years with quarterly payments of 5,483.36 at the end of each quarter. After 12 payments, the interest rate dropped to 6% compounded quarterly. The new quarterly payment dropped to 5,134.62. After 20 payments in total, the interest rate on the loan increased to 7% compounded quarterly. The investor decided to make an additional payment of

X at the time of his 20

th payment. After the additional payment was made, the new quarterly payment was calculated to be 4,265.73 payable for 5 more years. Determine X.

Answers: 1

Another question on Business

Business, 22.06.2019 00:20

Suppose an economy consists of three sectors: energy (e), manufacturing (m), and agriculture (a). sector e sells 70% of its output to m and 30% to a. sector m sells 30% of its output to e, 50% to a, and retains the rest. sector a sells 15% of its output to e, 30% to m, and retains the rest.

Answers: 1

Business, 22.06.2019 22:20

Which of the following best explains why the demand for housing is more flexible than the supply? a. new housing developments are being constructed all the time. b. low interest rates for mortgages make buying a home very affordable. c. the increasing population always drives demand upwards. d. people can move more easily than producers can build new homes.

Answers: 1

Business, 22.06.2019 22:40

Johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled $6,400,000, and the estimated bad debt percentage is 1.40%. the allowance for uncollectible accounts had a credit balance of $61,000 at the beginning of 2018 and $49,500, after adjusting entries, at the end of 2018.required: 1. what is bad debt expense for 2018 as a percent of net credit sales? 2. assume johnson makes no other adjustment of bad debt expense during 2018. determine the amount of accounts receivable written off during 2018.3. if the company uses the direct write-off method, what would bad debt expense be for 2018?

Answers: 1

Business, 23.06.2019 02:30

Is will able to claim r.j. as a qualifying child for the earned income credit (eic)?

Answers: 1

You know the right answer?

An investor took out a loan of 150,000 at 8% compounded quarterly, to be repaid over 10 years with q...

Questions

Mathematics, 01.03.2021 20:40

Mathematics, 01.03.2021 20:40

Social Studies, 01.03.2021 20:40

Mathematics, 01.03.2021 20:40

Mathematics, 01.03.2021 20:40

Mathematics, 01.03.2021 20:40

Biology, 01.03.2021 20:40

English, 01.03.2021 20:40

Mathematics, 01.03.2021 20:40

Mathematics, 01.03.2021 20:40

Mathematics, 01.03.2021 20:40

Computers and Technology, 01.03.2021 20:40