Business, 05.05.2020 18:18 priscillaan

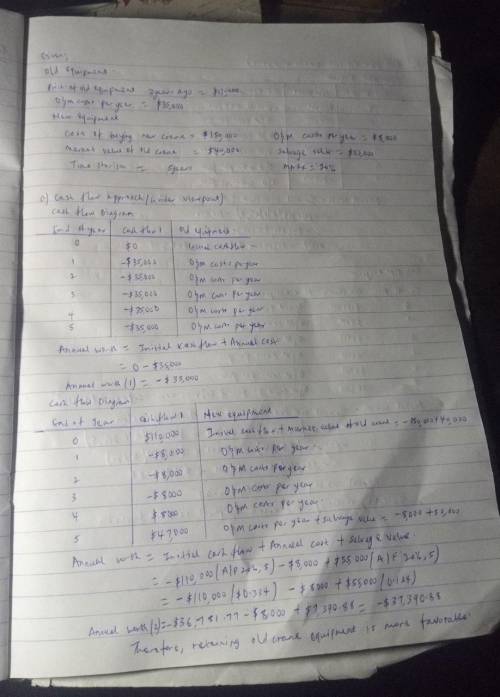

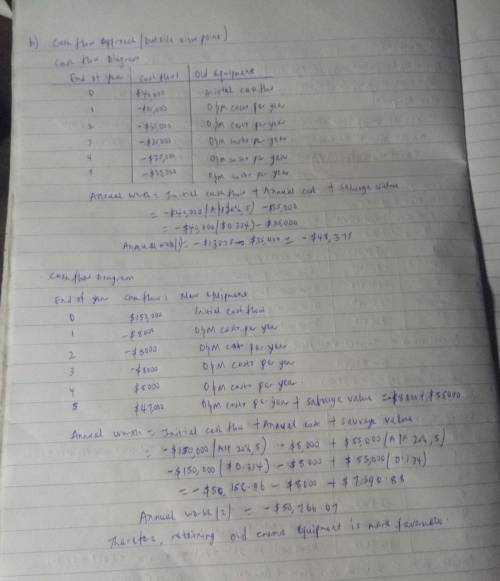

Allen Construction purchased a crane 6 years ago for $130,000. They need a crane of this capacity for the next five years. Normal operation costs $35,000 per year. The current crane will have no salvage value at the end of 5 more years. Allen can trade in the current crane for its market value of $40,000 toward the purchase of a new one that costs $150,000. The new crane will cost only $8000 per year under normal operating conditions and will have a salvage value of $55,000 after 5 years. If MARR is 20%, determine which option is preferred.

a. Use the cash flow approach (insider's viewpoint approach).

b. Use the opportunity cost approach (outsider's viewpoint approach).

Answers: 1

Another question on Business

Business, 21.06.2019 16:10

Which one of the following is most apt to align management's priorities with shareholders' interests? compensating managers with shares of stock that must be held for a minimum of three years holding corporate and shareholder meetings at high-end resort-type locations preferred by managers increasing the number of paid holidays that long-term employees are entitled to receive allowing employees to retire early with full retirement benefits paying a special management bonus on every fifth year of employment

Answers: 1

Business, 22.06.2019 13:30

The fiscal 2016 financial statements of nike inc. shows average net operating assets (noa) of $8,450 million, average net nonoperating obligations (nno) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million. the company's 2016 financial leverage (flev) is: select one: a. (0.477) b. (0.559 c. (0.323) d. (0.447) e. there is not enough information to determine the ratio.

Answers: 2

Business, 22.06.2019 21:30

Russell's study compared gpa of those students who volunteered for academic study skills training and those who did not elect to take the training. he found that those who had the training also had higher gpa. with which validity threat should russell be most concerned?

Answers: 2

Business, 22.06.2019 21:30

An allergy products superstore buys 6000 of their most popular model of air filters each year. the price of the air filters is $18. the cost of ordering and receiving shipments is $12 per order. accounting estimates annual carrying costs are 20% of the price. the supplier lead time is 2 days. the store operates 240 days per year. each order is received from the supplier in a single delivery. there are no quantity discounts. what is the store’s minimum total annual cost of placing orders & carrying inventory?

Answers: 1

You know the right answer?

Allen Construction purchased a crane 6 years ago for $130,000. They need a crane of this capacity fo...

Questions

Mathematics, 23.06.2019 01:00

Mathematics, 23.06.2019 01:00

Mathematics, 23.06.2019 01:00

English, 23.06.2019 01:00

Mathematics, 23.06.2019 01:10

Chemistry, 23.06.2019 01:10

Mathematics, 23.06.2019 01:10

Social Studies, 23.06.2019 01:10

Biology, 23.06.2019 01:10

Mathematics, 23.06.2019 01:10

Mathematics, 23.06.2019 01:10