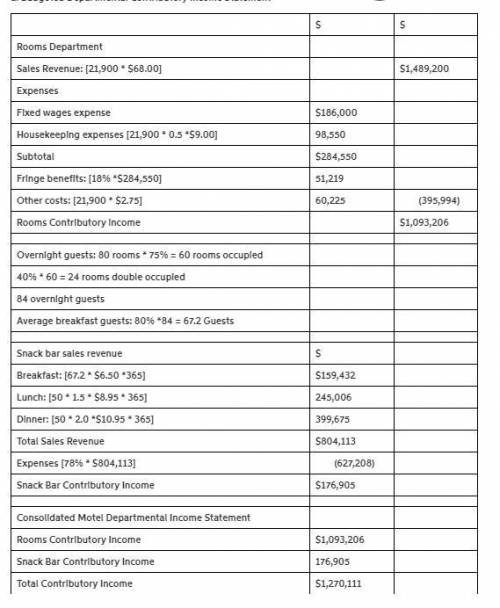

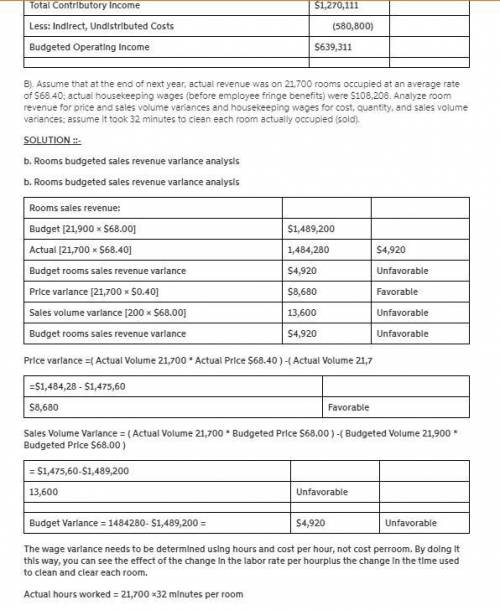

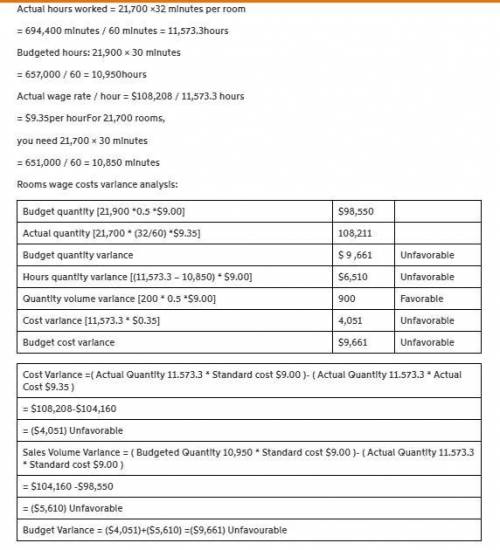

An 80-room motel forecasts its average room rate to be $68.00 for next year at 75% occupancy. The rooms department has a fixed wage cost of $186,000. Variable wage cost for housekeeping is $9.00 an hour; it takes one-half hour to clean a room. Fringe benefits are 18% of total wages. Linen, laundry, supplies, and other direct costs are $2.75 per occupied room per day. The motel also has a 50-seat, limited-menu snack bar. Breakfast revenue is derived solely from customers staying overnight in the motel. On average, 40% of occupied rooms are occupied by two persons and, on average, 80% of overnight guests will eat breakfast. Average breakfast check is $6.50. Lunch seat turnover is 1.5, with an average check of $8.95. The average dinner check is $10.95 and there are 2.0 seat turns for dinner. The snack bar is open 365 days a year for all three meals. Direct costs for the snack bar are 78% of total snack bar revenue. Indirect costs for the motel are estimated at $580,800 for next year. a. Calculate the budgeted contributory income statement for each department and a consolidated total motel departmental income statement to determine operating income. b. Assume that at the end of next year, actual revenue was on 21,700 rooms occupied at an average rate of $68.40; actual housekeeping wages (before employee fringe benefits) were $108,208. Analyze room revenue for price and sales volume variances and housekeeping wages for cost, quantity, and sales volume variances; assume it took 32 minutes to clean each room actually occupied (sold).

Answers: 2

Another question on Business

Business, 22.06.2019 16:00

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

Business, 22.06.2019 16:30

Suppose that electricity producers create a negative externality equal to $5 per unit. further suppose that the government imposes a $5 per-unit tax on the producers. what is the relationship between the after-tax equilibrium quantity and the socially optimal quantity of electricity to be produced?

Answers: 2

Business, 22.06.2019 19:40

Lauer corporation uses the periodic inventory system and has provided the following information about one of its laptop computers: date transaction number of units cost per unit 1/1 beginning inventory 210 $ 910 5/5 purchase 310 $ 1,010 8/10 purchase 410 $ 1,110 10/15 purchase 255 $ 1,160 during the year, lauer sold 1,025 laptop computers. what was cost of goods sold using the lifo cost flow assumption?

Answers: 1

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 2

You know the right answer?

An 80-room motel forecasts its average room rate to be $68.00 for next year at 75% occupancy. The ro...

Questions

Mathematics, 12.11.2019 13:31

Mathematics, 12.11.2019 13:31

English, 12.11.2019 13:31

Social Studies, 12.11.2019 13:31

History, 12.11.2019 13:31

Mathematics, 12.11.2019 13:31

Biology, 12.11.2019 13:31

History, 12.11.2019 13:31

Advanced Placement (AP), 12.11.2019 13:31

Geography, 12.11.2019 13:31

Mathematics, 12.11.2019 13:31

Physics, 12.11.2019 13:31