Business, 05.05.2020 04:13 floihqrrigweo

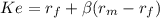

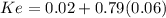

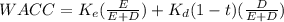

For the most recent fiscal year, book value of long-term debt at Schlumberger was $10,329 million. The market value of this long-term debt is approximately equal to its book value. Schlumberger’s share price currently is $47.2. The company has 1,000 million shares outstanding. Managers at Schlumberger estimate that the yield to maturity on any new bonds issued by the company will be 13.03%. Schlumberger’s marginal tax rate would be 35%. Schlumberger’s beta is 0.79. Suppose that the expected return on the market portfolio is 8% and the risk-free rate is 2%. Assume that the company will not change its capital structure. Also assume that the business risk of the projects under consideration is about the same as the business risk of Schlumberger as a whole. What would Schlumberger’s after-tax WACC be, given this information?

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

You have just been hired as a financial analyst for barrington industries. unfortunately, company headquarters (where all of the firm's records are kept) has been destroyed by fire. so, your first job will be to recreate the firm's cash flow statement for the year just ended. the firm had $100,000 in the bank at the end of the prior year, and its working capital accounts except cash remained constant during the year. it earned $5 million in net income during the year but paid $800,000 in dividends to common shareholders. throughout the year, the firm purchased $5.5 million of machinery that was needed for a new project. you have just spoken to the firm's accountants and learned that annual depreciation expense for the year is $450,000; however, the purchase price for the machinery represents additions to property, plant, and equipment before depreciation. finally, you have determined that the only financing done by the firm was to issue long-term debt of $1 million at a 6% interest rate. what was the firm's end- of-year cash balance? recreate the firm's cash flow statement to arrive at your answer

Answers: 1

Business, 22.06.2019 17:50

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Business, 22.06.2019 19:40

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

You know the right answer?

For the most recent fiscal year, book value of long-term debt at Schlumberger was $10,329 million. T...

Questions

Mathematics, 04.05.2021 01:00

Mathematics, 04.05.2021 01:00

Physics, 04.05.2021 01:00

Mathematics, 04.05.2021 01:00

Mathematics, 04.05.2021 01:00

Biology, 04.05.2021 01:00

Mathematics, 04.05.2021 01:00

English, 04.05.2021 01:00

Mathematics, 04.05.2021 01:00

Mathematics, 04.05.2021 01:00

Mathematics, 04.05.2021 01:00