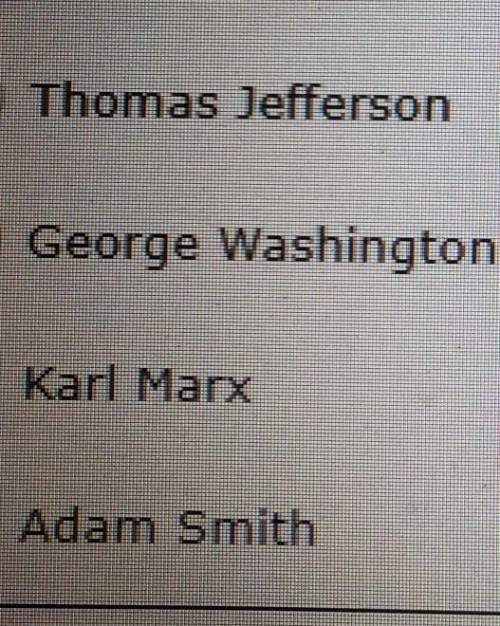

The first economist was:

...

Answers: 1

Another question on Business

Business, 22.06.2019 20:10

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept,the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year.to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

Business, 22.06.2019 22:40

Colorado rocky cookie company offers credit terms to its customers. at the end of 2018, accounts receivable totaled $715,000. the allowance method is used to account for uncollectible accounts. the allowance for uncollectible accounts had a credit balance of $50,000 at the beginning of 2018 and $30,000 in receivables were written off during the year as uncollectible. also, $3,000 in cash was received in december from a customer whose account previously had been written off. the company estimates bad debts by applying a percentage of 15% to accounts receivable at the end of the year. 1. prepare journal entries to record the write-off of receivables, the collection of $3,000 for previously written off receivables, and the year-end adjusting entry for bad debt expense.2. how would accounts receivable be shown in the 2018 year-end balance sheet?

Answers: 1

Business, 23.06.2019 01:30

At the end of the fiscal year, apha airlines has an outstanding non-cancellable purchase commitment for the purchase of 1 million gallons of jet fuel at a price of $4.10 per gallon for delivery during the coming summer. the company prices its inventory at the lower of cost or market. if the market price for jet fuel at the end of the year is $4.50, how would this situation be reflected in the annual financial statements?

Answers: 2

Business, 23.06.2019 08:10

Suppose that in the year 2020 the price level in the fictional country of demet is 100, and the governement is considering

Answers: 2

You know the right answer?

Questions

Mathematics, 28.01.2021 20:30

Mathematics, 28.01.2021 20:30

History, 28.01.2021 20:30

Chemistry, 28.01.2021 20:30

World Languages, 28.01.2021 20:30

Mathematics, 28.01.2021 20:30

Chemistry, 28.01.2021 20:30

Computers and Technology, 28.01.2021 20:30

Mathematics, 28.01.2021 20:30

Mathematics, 28.01.2021 20:30

Chemistry, 28.01.2021 20:30