Business, 05.05.2020 00:35 jairopanda8

Assume the following annual financial information for Kelli (age 30):

Income (after taxes) : $80,000

Savings : $2,500

Rent: $18,000

Dry Cleaning $200

Entertainment $2,000

Utilities $1,800

Car Payment $6,600

Auto Insurance $2,400

Student Loans $6,000

Credit Cards $1,200

Utilizing targeted benchmarks, which of the following statements is FALSE regarding Kelli’s financial situation?

a. Kelli's Housing Ratio 1 is adequate.

b. Kelli's emergency fund is adequate.

c. Kelli's Housing Ratio 2 is deficient.

d. Kelli's current ratio is less than 1

Utilizing investment assets to gross pay benchmarks, which of the following individuals is likely on target with their investment assets?

a. Jery age 55 earns $120,000 a year and has invested assets of $450,000.

b. Liam age 25 earns $45,000 a year and has invested assets of $5,500.

c. Sarah age 35 earns $90,000 a year and has invested assets of $325,000.

d. Alex age 45 earns $110,000 a year and has invested assets of $170,000.

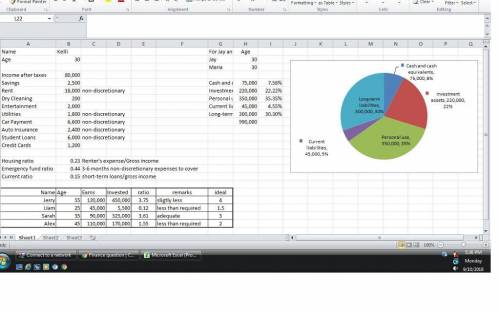

Use the following financial information for Jay (age 30) and Maria (age 30) Handberger:

a. Cash and Cash Equivalents: $75,000

b. Investment Assets: $220,000

c. Personal Use Assets: $350,000

d. Current Liabilities: $45,000

e. Long-Term iabilities: $300,000

Before your next meeting with the Handberger's, you create a pie chart to visually depict their current balance sheet. Utilizing targeted benchmarks, which of the following statements are you most likely to make during your next meetang?

a. "Your investment assets make up 34% of your asset pie chart, which is too low for your age group.

b. "Given your assets and liabilities, your net worth is appropriate for your age group.

c. "Relative to the rest of your assets, your cash and cash equivalents are too low for your age group.

d. "Compared to your net worth and current liabilities, your long-term liabilities are excessive for your age group.

Answers: 2

Another question on Business

Business, 22.06.2019 02:50

Acompany set up a petty cash fund with $800. the disbursements are as follows: office supplies $300 shipping $50 postage $30 delivery expense $350 to create the fund, which account should be credited? a. postage b. cash at bank c. supplies d. petty cash

Answers: 2

Business, 22.06.2019 13:00

Reliability and validity reliability and validity are two important considerations that must be made with any type of data collection. reliability refers to the ability to consistently produce a given result. in the context of psychological research, this would mean that any instruments or tools used to collect data do so in consistent, reproducible ways. unfortunately, being consistent in measurement does not necessarily mean that you have measured something correctly. to illustrate this concept, consider a kitchen scale that would be used to measure the weight of cereal that you eat in the morning. if the scale is not properly calibrated, it may consistently under- or overestimate the amount of cereal that’s being measured. while the scale is highly reliable in producing consistent results (e.g., the same amount of cereal poured onto the scale produces the same reading each time), those results are incorrect. this is where validity comes into play. validity refers to the extent to which a given instrument or tool accurately measures what it’s supposed to measure. while any valid measure is by necessity reliable, the reverse is not necessarily true. researchers strive to use instruments that are both highly reliable and valid.

Answers: 1

Business, 22.06.2019 13:20

In order to be thoughtful about the implementation of security policies and controls, leaders must balance the need to reduce with the impact to the business operations. doing so could mean phasing security controls in over time or be as simple as aligning security implementation with the business’s training events.

Answers: 3

Business, 22.06.2019 15:00

Why entrepreneurs start businesses. a) monopolistic competition b) perfect competition c) sole proprietorship d) profit motive

Answers: 1

You know the right answer?

Assume the following annual financial information for Kelli (age 30):

Income (after tax...

Income (after tax...

Questions

Chemistry, 17.03.2022 05:00

Mathematics, 17.03.2022 05:00

Computers and Technology, 17.03.2022 05:00

History, 17.03.2022 05:00

Chemistry, 17.03.2022 05:00

Geography, 17.03.2022 05:10

Mathematics, 17.03.2022 05:10

Biology, 17.03.2022 05:10

French, 17.03.2022 05:10