Business, 05.05.2020 17:39 lexylexy8583

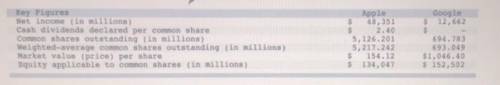

Use the following comparative figures for Apple and Google. Google 12.662 $ Key Figures Net income (in millions) Cash dividends declared per common share Common shares outstanding in millions) Weighted average common shares outstanding (in millions) Market value (price) per share Equity applicable to common shares (in millions) Apple $ 48,351 $ 2.40 5,126.201 5,217.242 $ 154.12 $ 134,047 694.783 693.049 $1.046.40 $152,502 Required: 1. Compute the book value per common share for each company using these data. 2. Compute the basic EPS for each company using these data. 3. Compute the dividend yield for each company using these data. 4. Compute the price-earnings ratio for each company using these data. 5. Based on the PE ratio, for which company do investors have greater expectations about future performance? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the book value per common share for each company using these data. (Round your answers to 2 decimal places.) Book Value Per Common Share Apple Google

Answers: 2

Another question on Business

Business, 21.06.2019 19:40

Policymakers are provided data about the private and social benefits of a good being sold in the market. quantity private mb ($) social mb ($) 6 6 9 7 4 7 8 2 5 9 0 3 what is the size of the externality? if the externality is positive, enter a positive number. if negative, make it a negative number. $ given this data, policymakers must decide whether to address the associated externality with a subsidy or a tax. as their economic consultant, which of the two policy tools would you recommend? a subsidy a tax

Answers: 2

Business, 22.06.2019 11:30

Chuck, a single taxpayer, earns $80,750 in taxable income and $30,750 in interest from an investment in city of heflin bonds. (use the u.s. tax rate schedule.) (do not round intermediate calculations. round your answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 15:50

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

Business, 22.06.2019 17:10

Calculate riverside’s financial ratios for 2014. assume that riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (hint: use the book discussion to identify the applicable ratios.)

Answers: 3

You know the right answer?

Use the following comparative figures for Apple and Google. Google 12.662 $ Key Figures Net income (...

Questions

Health, 12.08.2021 14:10

World Languages, 12.08.2021 14:10

English, 12.08.2021 14:10

Mathematics, 12.08.2021 14:10

History, 12.08.2021 14:10

Computers and Technology, 12.08.2021 14:10

Chemistry, 12.08.2021 14:10

Mathematics, 12.08.2021 14:10

Mathematics, 12.08.2021 14:10

English, 12.08.2021 14:10

Social Studies, 12.08.2021 14:10

Chemistry, 12.08.2021 14:10

Physics, 12.08.2021 14:10

Business, 12.08.2021 14:10