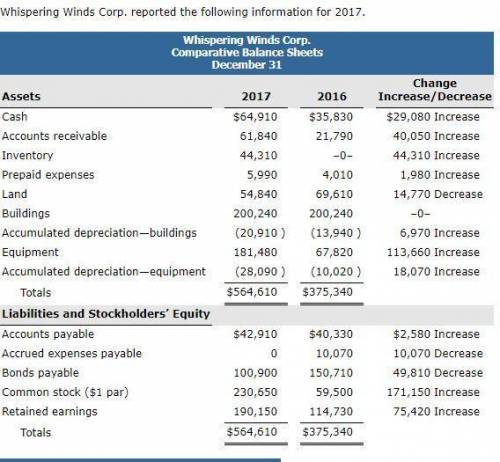

Whispering Winds Corp. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of goods sold Operating expenses Interest expense Loss on disposal of equipment Income before income taxes Income tax expense Net income $941,820 $472,100 229,800 11,970 2,020 715,890 225,930 64,830 $161,100 Additional information: 1. Operating expenses include depreciation expense of $40,160 2. Land was sold at its book value for cash. 3. Cash dividends of $85,680 were declared and paid in 2017 4. Equipment with a cost of $164,450 was purchased for cash. Equipment with a cost of $50,790 and a book value of $35,670 was sold for $33,650 cash. 5. Bonds of $49,810 were redeemed at their face value for cash. 6. Common stock ($1 par) of $171,150 was issued for cash.

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

Sarah borrowed $16,500 on may 23 with interest due on september 3. if the interest rate is 9%, find the interest on the loan using exact interest and ordinary interest.

Answers: 2

Business, 22.06.2019 00:00

If his parents cannot alex with college, and two of his scholarships will be awarded to other students if he does not accept them immediately, which is the best option for him?

Answers: 1

Business, 22.06.2019 02:00

Kenney co. uses process costing to account for the production of canned energy drinks. direct materials are added at the beginning of the process and conversion costs are incurred uniformly throughout the process. equivalent units have been calculated to be 19,200 units for materials and 16,000 units for conversion costs. beginning inventory consisted of $11,200 in materials and $6,400 in conversion costs. april costs were $57,600 for materials and $64,000 for conversion costs. ending inventory still in process was 6,400 units (100% complete for materials, 50% for conversion). the total cost per unit using the weighted average method would be closest to:

Answers: 2

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

You know the right answer?

Whispering Winds Corp. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of g...

Questions

History, 16.10.2020 23:01

Mathematics, 16.10.2020 23:01

Mathematics, 16.10.2020 23:01

History, 16.10.2020 23:01

English, 16.10.2020 23:01

Geography, 16.10.2020 23:01

Law, 16.10.2020 23:01

Mathematics, 16.10.2020 23:01

Mathematics, 16.10.2020 23:01

Mathematics, 16.10.2020 23:01

Mathematics, 16.10.2020 23:01