Business, 06.05.2020 05:33 solikhalifeoy3j1r

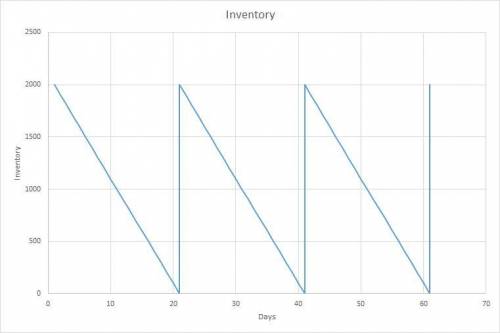

Rego Circuits supplies microcomputer circuitry for customers that build super computers. Their annual demand is 36,000 units, with a setup cost of $25 per batch and a holding cost of $0.45 per unit per year. Their manufacturing facility can produce circuits at a rate of 300 units per day, and they are able to operate 360 days a year. (Total 10 Points) a) What is Cesar Rego’s economic production quantity? What is the maximum inventory level, the time between orders, the total setup cost, and the total holding cost for this EPQ? (5 Points) b) Please draw one inventory cycle of the saw tooth model for this EPQ. Do not forget to label the x and y axis on your model! (5 Points)

Answers: 1

Another question on Business

Business, 22.06.2019 12:30

land, a building and equipment are acquired for a lump sum of $ 1,000,000. the market values of the land, building and equipment are $ 300,000, $ 800,000 and $ 300,000, respectively. what is the cost assigned to the equipment? (do not round any intermediary calculations, and round your final answer to the nearest dollar.)

Answers: 1

Business, 22.06.2019 19:10

After the price floor is instituted, the chairman of productions office buys up any barrels of gosum berries that the producers are not able to sell. with the price floor, the producers sell 300 barrels per month to consumers, but the producers, at this high price floor, produce 700 barrels per month. how much producer surplus is created with the price floor? show your calculations.

Answers: 2

Business, 22.06.2019 19:50

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

Business, 22.06.2019 21:40

Heather has been an active participant in a defined benefit plan for 19 years. during her last 6 years of employment, heather earned $42,000, $48,000, $56,000, $80,000, $89,000, and $108,000, respectively (representing her highest-income years). calculate heather’s maximum allowable benefits from her qualified plan (assume that there are fewer than 100 participants). assume that heather’s average compensation for her three highest years is $199,700. calculate her maximum allowable benefits.

Answers: 3

You know the right answer?

Rego Circuits supplies microcomputer circuitry for customers that build super computers. Their annua...

Questions

Computers and Technology, 17.10.2019 07:10

Geography, 17.10.2019 07:10

English, 17.10.2019 07:10

Mathematics, 17.10.2019 07:10

Physics, 17.10.2019 07:10

Mathematics, 17.10.2019 07:10

Biology, 17.10.2019 07:10

Spanish, 17.10.2019 07:10

Mathematics, 17.10.2019 07:10

English, 17.10.2019 07:10

English, 17.10.2019 07:10