Business, 06.05.2020 09:01 kingjonesjr

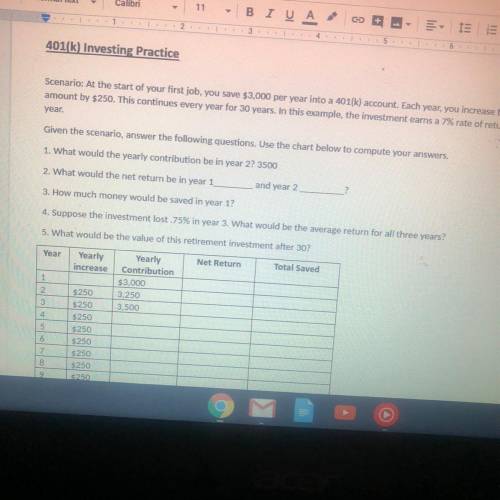

Scenario: At the start of your first job, you save $3,000 per year into a 401(k) account. Each year, you increase that

amount by $250. This continues every year for 30 years. In this example, the investment earns a 7% rate of return each

year.

Given the scenario, answer the following questions. Use the chart below to compute your answers.

1. What would the yearly contribution be in year 2? 3500

2. What would the net return be in year 1_

and year 2

3. How much money would be saved in year 1?

4. Suppose the investment lost.75% in year 3. What would be the average return for all three years?

5. What would be the value of this retirement investment after 30?

Answers: 1

Another question on Business

Business, 21.06.2019 14:00

Before downloading a new app on your phone, you need to pay attention to

Answers: 2

Business, 22.06.2019 11:20

Money aggregates identify whether each of the following examples belongs in m1 or m2. if an example belongs in both, be sure to check both boxes. example m1 m2 gilberto has a roll of quarters that he just withdrew from the bank to do laundry. lorenzo has $25,000 in a money market account. neha has $8,000 in a two-year certificate of deposit (cd).

Answers: 3

Business, 22.06.2019 18:00

Abbington company has a manufacturing facility in brooklyn that manufactures robotic equipment for the auto industry. for year 1, abbingtonabbington collected the following information from its main production line: actual quantity purchased-200 units, actual quantity used-110 units, units standard quantity-100 units, actual price paid-$8 per unit, standard price-$10 per unit. atlantic isolates price variances at the time of purchase. what is the materials price variance for year 1? 1. $400 favorable. 2. $400 unfavorable. 3. $220 favorable. 4. $220 unfavorable.

Answers: 2

Business, 22.06.2019 19:20

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

You know the right answer?

Scenario: At the start of your first job, you save $3,000 per year into a 401(k) account. Each year,...

Questions

History, 09.12.2020 21:00

Mathematics, 09.12.2020 21:00

Biology, 09.12.2020 21:00

Mathematics, 09.12.2020 21:00

Mathematics, 09.12.2020 21:00

English, 09.12.2020 21:00

Mathematics, 09.12.2020 21:00

Social Studies, 09.12.2020 21:00