Consider the following situations for Shocker

1. On November 28, 2021, Shocker receives a $4,...

Business, 22.05.2020 03:02 nialphonsa

Consider the following situations for Shocker

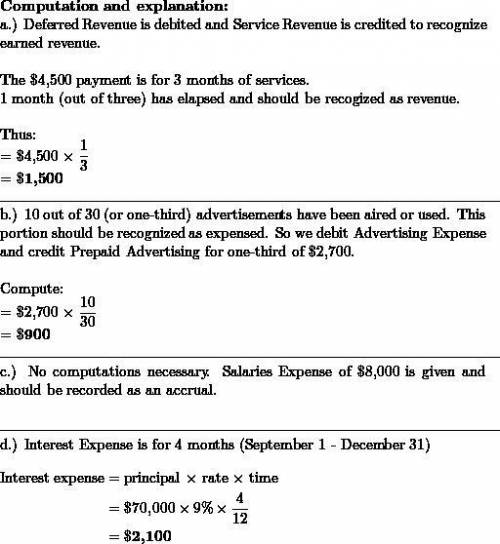

1. On November 28, 2021, Shocker receives a $4,350 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue is credited.

2. On December 1, 2021, the company pays a local radio station $2,670 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising is debited.

3. Employee salaries for the month of December totaling $7.900 will be paid on January 7, 2022

4 OnAugust 31, 2021, Shocker borrows $69,000 from a local bank. A note is signed with principal and 8% i terest to be paid on August 31, 2022

Required:

Record the necessary adjusting entries for Shocker at December 31, 2021. No adjusting entries were made during the year.

Answers: 2

Another question on Business

Business, 22.06.2019 03:20

Look at this check register. calculate the current balance. check date transaction (+) deposit balance 5/1 5/3 $82.92 debit 8.00 78.24 005 monthly fee phone bill paycheck 1 125.00 5/15 5/17 5/20 atm 40.00 56.50 006 t ennis lessons the current balance is?

Answers: 1

Business, 22.06.2019 13:10

Paid-in-capital in excess of par represents the amount of proceeds a. from the original sale of common stock b. in excess of the par value from the original sale of common stock c. at the current market value of the common stock d. at the curent book value of the common stock

Answers: 1

Business, 22.06.2019 14:30

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

You know the right answer?

Questions

English, 05.05.2020 05:10

Biology, 05.05.2020 05:10

Chemistry, 05.05.2020 05:10

English, 05.05.2020 05:10

Chemistry, 05.05.2020 05:10

Mathematics, 05.05.2020 05:10

Mathematics, 05.05.2020 05:10