Business, 27.05.2020 19:06 anonwarrior

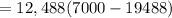

During the year, Anna rented her vacation home for 87 days, used it personally for 13 days, and left it vacant for 265 days. She had the following income and expenses: Rent income $7,000 Expenses Real estate taxes 2,500 Interest on mortgage 9,000 Utilities 2,400 Repairs 1,000 Roof replacement (a capital expenditure) 12,000 Depreciation 7,500 If required, round your answers to the nearest dollar. If an amount is zero, enter "0". Assume 365 days in a year. a. Is her vacation home classified as rental property? Yes b. Compute the following regarding the rental use of the property: Gross income: $ 7,000 Total expenses: $ 19,488 c. Anna has a net rental loss of $ 12,488 this year. d. What amount of the real estate taxes can Anna deduct as an itemized deduction? $ 4,600 e. What amount of the mortgage interest can Anna deduct as an itemized deduction?

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

Jelly has joined drakes team drake sends kelly an email explaining details of the project that she will be working on which of these is good etiquette

Answers: 3

Business, 22.06.2019 11:50

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a.change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c.stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

Business, 22.06.2019 12:20

Consider 8.5 percent swiss franc/u.s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 15:00

Ineed this asap miguel's boss asks him to distribute information to the entire staff about a mandatory meeting. in 1–2 sentences, describe what miguel should do.

Answers: 1

You know the right answer?

During the year, Anna rented her vacation home for 87 days, used it personally for 13 days, and left...

Questions

Biology, 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

Advanced Placement (AP), 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

English, 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

Mathematics, 20.05.2021 01:10

![Total \ expenses = (2500+9000+2400+1000+7500) - personal \ deduction[(2500+9000+2400+1000+7500)\times \frac{13}{100} ]](/tpl/images/0667/2962/d4999.png)