Business, 28.05.2020 10:57 emilyrobles

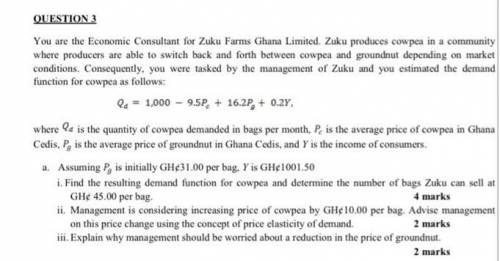

You are the Economic Consultant for Zuku Farms Ghana Limited. Zuku produces cowpea in a community

where producers are able to switch back and forth between cowpea and groundnut depending on market

conditions. Consequently, you were tasked by the management of Zuku and you estimated the demand

function for cowpea as follows:

where is the quantity of cowpea demanded in bags per month, is the average price of cowpea in Ghana

Cedis, is the average price of groundnut in Ghana Cedis, and Y is the income of consumers.

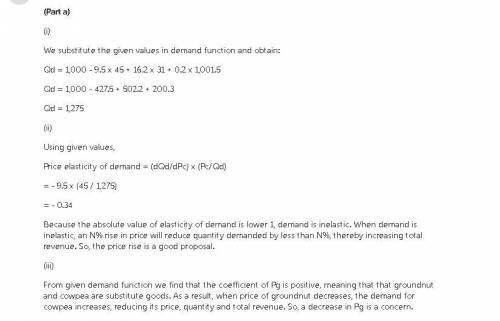

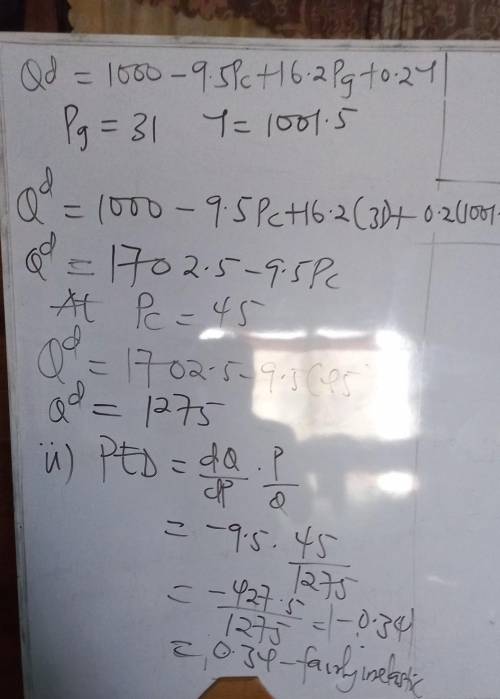

a. Assuming is initially GH¢31.00 per bag, Y is GH¢1001.50

i. Find the resulting demand function for cowpea and determine the number of bags Zuku can sell at

GH¢ 45.00 per bag. 4 marks

ii. Management is considering increasing price of cowpea by GH¢10.00 per bag. Advise management

on this price change using the concept of price elasticity of demand. 2 marks

iii. Explain why management should be worried about a reduction in the price of groundnut.

2 marks

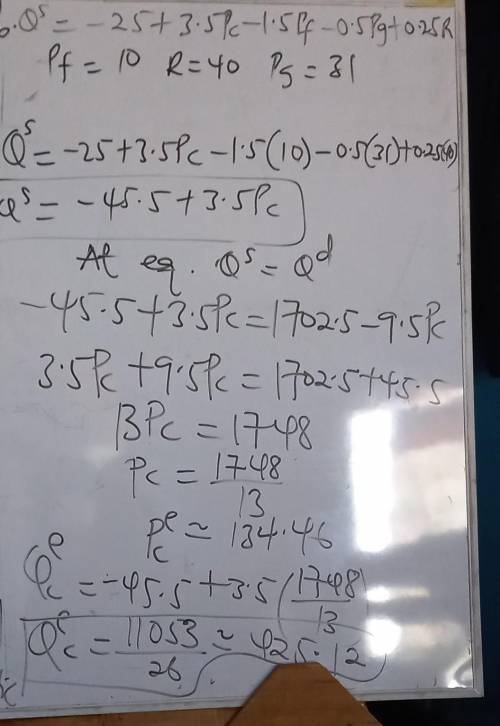

Assume also that your estimated supply function for cowpea as follows:

Where is the quantity supplied of cowpea in bags, and are as defined above, is the price of

fertilizer per bag, is the amount of rainfall (in inches).

If inches and = GH¢31.00.

b. Find the resulting supply function for cowpea and determine the equilibrium price and quantity.

4 marks

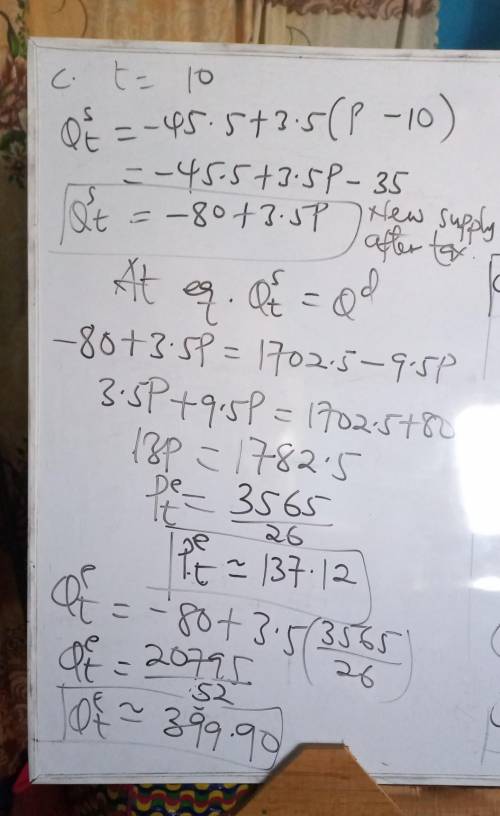

c. Assuming the government imposes a tax of GH¢10 on every bag of cowpea sold, determine the new

equilibrium price and quantity. Explain the effect of the policy on the market.

6 marks

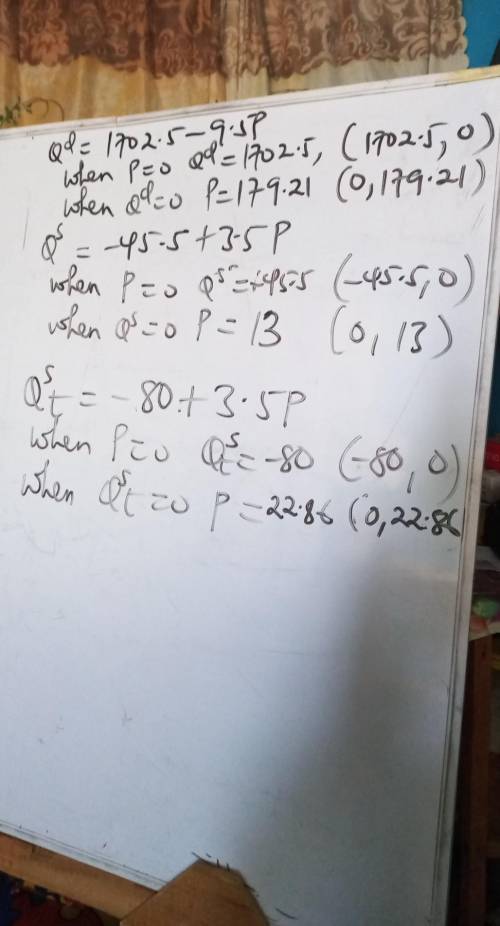

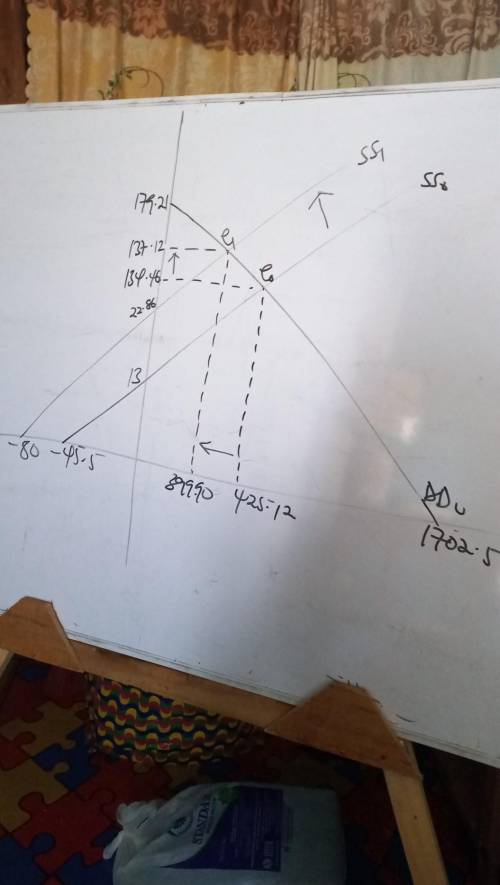

d. Sketch the demand curve and the supply curves for cowp

Answers: 3

Another question on Business

Business, 22.06.2019 08:20

How much does a neurosurgeon can make most in canada? give me answer in candian dollar

Answers: 1

Business, 22.06.2019 12:50

Required information problem 15-1a production costs computed and recorded; reports prepared lo c2, p1, p2, p3, p4 [the following information applies to the questions displayed below. marcelino co.'s march 31 inventory of raw materials is $84,000. raw materials purchases in april are $540,000, and factory payroll cost in april is $364,000. overhead costs incurred in april are: indirect materials, $59,000; indirect labor, $26,000; factory rent, $38,000; factory utilities, $19,000; and factory equipment depreciation, $58,000. the predetermined overhead rate is 50% of direct labor cost. job 306 is sold for $670,000 cash in april. costs of the three jobs worked on in april follow. job 306 job 307 job 308 balances on march 31 direct materials $30,000 $36,000 direct labor 25,000 14,000 applied overhead 12,500 7,000 costs during april direct materials 133,000 210,000 $100,000 direct labor 105,000 150,000 101,000 applied overhead ? ? ? status on april 30 finished (sold) finished in process (unsold) required: 1. determine the total of each production cost incurred for april (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from march 31). a-materials purchases (on credit). b-direct materials used in production. c-direct labor paid and assigned to work in process inventory. d-indirect labor paid and assigned to factory overhead. e-overhead costs applied to work in process inventory. f-actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) g-transfer of jobs 306 and 307 to finished goods inventory. h-cost of goods sold for job 306. i-revenue from the sale of job 306. j-assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions. 3. prepare a schedule of cost of goods manufactured. 4.1 compute gross profit for april. 4.2 show how to present the inventories on the april 30 balance sheet.

Answers: 3

Business, 22.06.2019 20:00

What part of the rational model of decision-making does the former business executive “elliott” have a problem completing?

Answers: 2

Business, 22.06.2019 23:00

Doogan corporation makes a product with the following standard costs: standard quantity or hours standard price or rate direct materials 2.0 grams $ 7.00 per gram direct labor 1.6 hours $ 12.00 per hour variable overhead 1.6 hours $ 6.00 per hour the company produced 5,000 units in january using 10,340 grams of direct material and 2,320 direct labor-hours. during the month, the company purchased 10,910 grams of the direct material at $7.30 per gram. the actual direct labor rate was $12.85 per hour and the actual variable overhead rate was $5.80 per hour. the company applies variable overhead on the basis of direct labor-hours. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for january is:

Answers: 1

You know the right answer?

You are the Economic Consultant for Zuku Farms Ghana Limited. Zuku produces cowpea in a community

Questions

English, 10.11.2020 04:40

Social Studies, 10.11.2020 04:40

Social Studies, 10.11.2020 04:40

Mathematics, 10.11.2020 04:40

Mathematics, 10.11.2020 04:40

Mathematics, 10.11.2020 04:40

Mathematics, 10.11.2020 04:40

Biology, 10.11.2020 04:40

Mathematics, 10.11.2020 04:40