Business, 31.05.2020 01:02 earthangel456

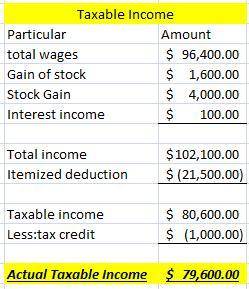

Bob Katz and Sally Mander are a married couple with four children. Total wages for 2018 equaled $96,400. Stock which had been purchased nine months earlier was sold for a $1,600 gain and stock held for three years was sold for a $4,000 gain. Interest income from savings was $100. Itemized deductions totaled $21,500. Bob and Sally qualify for a $1,000 tax credit. What is Bob's and Sally's taxable income

Answers: 1

Another question on Business

Business, 22.06.2019 00:10

Which of the following is a problem for the production of public goods?

Answers: 2

Business, 22.06.2019 06:30

If the findings and the results are not presented properly, the research completed was a waste of time and money. true false

Answers: 1

Business, 22.06.2019 08:30

What is the key to success in integrating both lethal and nonlethal activities during planning? including stakeholders once a comprehensive operational approach has been determined knowing the commander's decision making processes and "touch points" including stakeholders from the very beginning of the design and planning process including the liaison officers (lnos) in all the decision points?

Answers: 1

Business, 22.06.2019 14:50

The following information is needed to reconcile the cash balance for gourmet catering services. * a deposit of $5,600 is in transit. * outstanding checks total $1,000. * the book balance is $6,400 at february 28, 2019. * the bookkeeper recorded a $1,800 check as $17,200 in payment of the current month's rent. * the bank balance at february 28, 2019 was $17,410. * a deposit of $400 was credited by the bank for $4,000. * a customer's check for $3,300 was returned for nonsufficient funds. * the bank service charge is $90. what was the adjusted book balance?

Answers: 1

You know the right answer?

Bob Katz and Sally Mander are a married couple with four children. Total wages for 2018 equaled $96,...

Questions

Computers and Technology, 11.06.2021 01:20

Mathematics, 11.06.2021 01:20

Mathematics, 11.06.2021 01:20

Mathematics, 11.06.2021 01:20