Business, 31.05.2020 03:00 Calliedevore

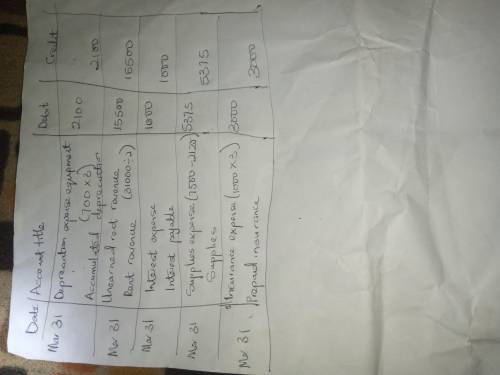

The ledger of Blue Spruce Corp. on March 31 of the current year includes the selected accounts below before adjusting entries have been prepared. Debit Credit Supplies $7,500 Prepaid Insurance 9,000 Equipment 62,500 Accumulated Depreciation—Equipment $21,000 Notes Payable 50,000 Unearned Rent Revenue 31,000 Rent Revenue 150,000 Interest Expense 0 Salaries and Wages Expense 35,000 An analysis of the accounts shows the following. 1. The equipment depreciates $700 per month. 2. Half of the unearned rent revenue was earned during the quarter. 3. Interest of $1,000 is accrued on the notes payable. 4. Supplies on hand total $2,125. 5. Insurance expires at the rate of $1,000 per month. Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

In the rbv are defined as the tangible and intangible assets that a firm controls that it can use to conceive and implement its strategies.answers: management policies

Answers: 1

Business, 21.06.2019 21:20

20. sinclair company's single product has a selling price of $25 per unit. last year the company reported a profit of $20,000 and variable expenses totaling $180,000. the product has a 40% contribution margin ratio. because of competition, sinclair company will be forced in the current year to reduce its selling price by $2 per unit. how many units must be sold in the current year to earn the same profit as was earned last year? a. 15,000 units b. 12,000 units c. 16,500 units d. 12,960 units

Answers: 1

Business, 22.06.2019 04:30

How does your household gain from specialization and comparative advantage? (what is produced, what is not produced yet paid to a specialist to produce? )

Answers: 3

Business, 22.06.2019 05:20

Carmen co. can further process product j to produce product d. product j is currently selling for $20 per pound and costs $15.75 per pound to produce. product d would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. what is the differential revenue of producing product d?

Answers: 2

You know the right answer?

The ledger of Blue Spruce Corp. on March 31 of the current year includes the selected accounts below...

Questions

Mathematics, 17.06.2021 14:50

Mathematics, 17.06.2021 14:50

Mathematics, 17.06.2021 14:50

History, 17.06.2021 15:00

History, 17.06.2021 15:00

Arts, 17.06.2021 15:00

Advanced Placement (AP), 17.06.2021 15:00

Mathematics, 17.06.2021 15:00

Chemistry, 17.06.2021 15:00

Mathematics, 17.06.2021 15:00

Mathematics, 17.06.2021 15:00