Business, 05.06.2020 16:58 Gearyjames8

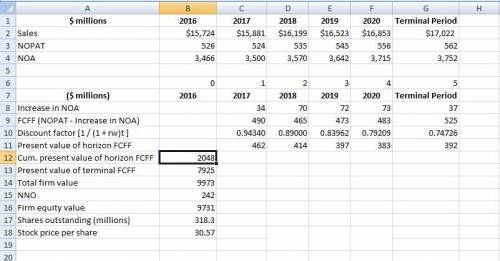

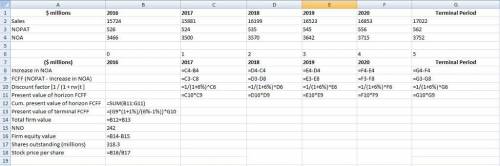

Estimating Share Value Using the DCF Model Following are forecasts of Whole Foods sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of September 25, 2016.

Reported Horizon Period

$ millions 2016 2017 2018 2019 2020 Terminal Period

Sales $15,724 $15,881 $16,199 $16,523 $16,853 $17,022

NOPAT 526 524 535 545 556 562

NOA 3,466 3,500 3,570 3,642 3,715 3,752

Answer the following requirements assuming a discount rate (WACC) of 6%, a terminal period growth rate of 1%, common shares outstanding of 318.3 million, and net nonoperating obligations (NNO) of $242 million.

(a) Estimate the value of a share of Whole Foods' common stock using the discounted cash flow (DCF) model as of September 25, 2016.

Rounding instructions:

Round answers to the nearest whole number unless noted otherwise. Use your rounded answers for subsequent calculations.

Do not use negative signs with any of your answers.

Reported Forecast Horizon

($ millions) 2016 2017 2018 2019 2020 Terminal Period

Increase in NOA Answer Answer Answer Answer Answer

FCFF (NOPAT - Increase in NOA) Answer Answer Answer Answer Answer

Discount factor [1 / (1 + rw)t ] (Round 5 decimal places) Answer Answer Answer Answer

Present value of horizon FCFF Answer Answer Answer Answer

CUMULATIVE present value of horizon FCFF $ Answer

Present value of terminal FCFF Answer

Total firm value Answer NNO Answer

Firm equity value $ Answer

Shares outstanding (millions) Answer (Round one decimal place)

Stock price per share $ Answer (Round two decimal places)

(b) Whole Foods stock closed at $30.96 on November 18, 2016, the date the 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference?

A. Stock prices are a function of many factors. It is impossible to speculate on the reasons for the difference.

B. Our stock price estimate is only a few cents lower than the Whole Foods market price, indicating that we believe that Whole Foods stock is accurately priced. Our stock price estimate is lower than the Whole Foods market price, indicating that we believe that Whole Foods stock is overvalued.

C. Stock prices are a function of expected NOPAT and NOA, as well as the WACC discount rate. Our lower stock price estimate might be due to more optimistic forecasts or a lower discount rate compared to other investors' and analysts' model assumptions.

D. Our stock price estimate is lower than the Whole Foods market price, indicating that we believe that Whole Foods stock is undervalued. Stock prices are a function of expected NOPAT and NOA, as well as the WACC discount rate. Our lower stock price estimate might be due to more optimistic forecasts or a lower discount rate compared to other investors' and analysts' model assumptions.

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

During the first month of operations, martinson services, inc., completed the following transactions: jan 2 martinson services received $65,000 cash and issued common stock to the stockholders. 3 purchased supplies, $1,000, and equipment, $12,000, on account. 4 performed services for a customer and received cash, $5,500. 7 paid cash to acquire land, $39,000. 11 performed services for a customer and billed the customer, $4,100. martinson expects to collect within one month 16 paid for the equipment purchased january 3 on account. 17 paid for newspaper advertising, $600. 18 received partial payment from customer on account, $2,000. 22 paid the water and electricity bills, $430. 29 received $2,600 cash for servicing the heating unit of a customer. 31 paid employee salary, $2,900. 31 declared and paid dividends of $1,800. requirements 1. record each transaction in the journal. key each transaction by date. explanations are not required. 2. post the transactions to the t-accounts, using transaction dates as posting references. label the ending balance of each account bal, as shown in the chapter. 3. prepare the trial balance of martinson services, inc., at january 31 of the current year. 4. mark martinson, the manager, asks you how much in total resources the business has to work with, how much it owes, and whether january was profitable (and by how much)?

Answers: 1

Business, 21.06.2019 22:50

The leading producer of cell phone backup batteries, jumpstart, has achieved great success because they produce high-quality battery backups that are not too expensive. even so, another company that produces lower-quality batteries at the same price has also achieved some success, but not as much as jumpstart. also, in general, the price of backup batteries has declined because of economies of scale and learning. in addition, jumpstart has added complementary assets, such as a carrying case. considering all of these factors, the backup battery industry is most likely in the introduction stage. growth stage. shakeout stage. maturity stage.

Answers: 2

Business, 22.06.2019 06:30

"in my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said wim niewindt, managing director of antilles refining, n.v., of aruba. "at a price of $21 per drum, we would be paying $4.70 less than it costs us to manufacture the drums in our own plant. since we use 70,000 drums a year, that would be an annual cost savings of $329,000." antilles refining's current cost to manufacture one drum is given below (based on 70,000 drums per year):

Answers: 1

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

You know the right answer?

Estimating Share Value Using the DCF Model Following are forecasts of Whole Foods sales, net operati...

Questions

Mathematics, 27.02.2021 05:00

Mathematics, 27.02.2021 05:00

Mathematics, 27.02.2021 05:00

Mathematics, 27.02.2021 05:00

Mathematics, 27.02.2021 05:00

History, 27.02.2021 05:00