Consider the single factor APT. Portfolio A has a beta of 1.3 and an expected return of 21%. Portfolio B has a beta of .7 and an expected return of 17%. The risk-free rate of return is 8%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio and a long position in portfolio .

A. B;A

B. A;B

C. B;B

D. A; A

The portfolio weight in A is

The portfolio weight in B is

The portfolio weight in risk-free is

Answers: 3

Another question on Business

Business, 21.06.2019 22:50

The following data pertains to activity and costs for two months: june july activity level in 10,000 12,000 direct materials $16,000 $ ? fixed factory rent 12,000 ? manufacturing overhead 10,000 ? total cost $38,000 $42,900 assuming that these activity levels are within the relevant range, the manufacturing overhead for july was: a) $10,000 b) $11,700 c) $19,000 d) $9,300

Answers: 2

Business, 22.06.2019 05:50

Cosmetic profits. sally is the executive vice president of big name cosmetics company. through important and material, nonpublic information, she learns that the company is soon going to purchase a smaller chain of stores. it is expected that stock in big name cosmetics will rise dramatically at that point. sally immediately buys a number of shares of her company's stock. she also tells her friend alice about the expected purchase of stores. alice wanted to purchase stock in the company but lacked the funds with which to do so. although she did not have the funds in bank a, alice decided to draw a check on bank a and deposit the check in bank b and then proceed to write a check on bank b to cover the purchase of the stock. she hoped that she would have sufficient funds to deposit before the check was presented for payment. of which of the following offenses, if any, is alice guilty of by buying stock?

Answers: 2

Business, 22.06.2019 23:00

Acollege registrar's office requires you to first visit with one of three advisors and then with one of two financial professionals. this system best described as which of the following? a. single server, single phase systemb. multiple server multiphase systemc. multiple server, cross phase systemd. single server, multiphase systeme. multiple server, single phase system

Answers: 2

You know the right answer?

Consider the single factor APT. Portfolio A has a beta of 1.3 and an expected return of 21%. Portfol...

Questions

Mathematics, 02.12.2021 18:10

English, 02.12.2021 18:10

Chemistry, 02.12.2021 18:10

SAT, 02.12.2021 18:10

Mathematics, 02.12.2021 18:10

Mathematics, 02.12.2021 18:10

Mathematics, 02.12.2021 18:10

Mathematics, 02.12.2021 18:10

English, 02.12.2021 18:10

English, 02.12.2021 18:10

Computers and Technology, 02.12.2021 18:10

Chemistry, 02.12.2021 18:10

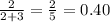

= 40% (short)

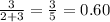

= 40% (short)  = 60% (long)

= 60% (long)