Business, 06.06.2020 23:59 shawn20034

Overton Company has gathered the following information.

Units in beginning work in process 20,000

Units started into production 164,000

Units in ending work in process 24,000

Percent complete in ending work in process:

Conversion costs 60%

Materials 100%

Costs incurred:

Direct materials $101,200

Direct labor $164,800

Overhead $184,000

Instructions

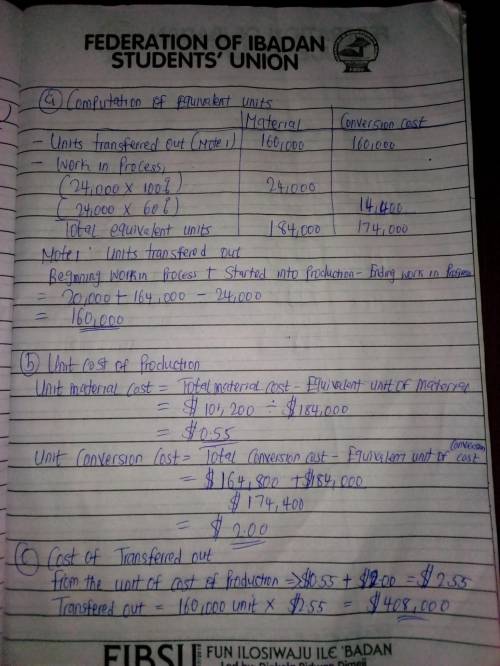

(a) Compute equivalent units of production for materials and for conversion costs.

(b) Determine the unit costs of production.

(c) Show the assignment of costs to units transferred out and in process.

Answers: 2

Another question on Business

Business, 21.06.2019 14:00

The new york stock exchange is an example of physical or individual

Answers: 2

Business, 22.06.2019 19:10

Ancho corp. is an automobile company whose core competency lies in manufacturing petrol- and diesel- based cars. the company realizes that more of its potential customers are switching to electric cars. the r& d department of the company acquires competencies in developing electric cars and launches its first hybrid car, which uses both gas and electricity. in this scenario, ancho is primarilya. leveraging new core competencies to improve current market position. b. redeploying existing core competencies to compete in future markets. c. unlearning existing core competencies to create and compete in markets of the future. d. building new core competencies to protect and extend current market position

Answers: 3

Business, 22.06.2019 19:40

Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. he now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. how many years will it take to exhaust his funds, i.e., run the account down to zero? a. 22.50 b. 23.63 c. 24.81 d. 26.05 e. 27.35

Answers: 2

Business, 22.06.2019 20:20

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

You know the right answer?

Overton Company has gathered the following information.

Units in beginning work in process 20,000

Questions

Mathematics, 05.05.2020 07:12

Mathematics, 05.05.2020 07:12

Computers and Technology, 05.05.2020 07:12

Biology, 05.05.2020 07:12

Spanish, 05.05.2020 07:12

Mathematics, 05.05.2020 07:12

History, 05.05.2020 07:12

English, 05.05.2020 07:12

Mathematics, 05.05.2020 07:12

Mathematics, 05.05.2020 07:12

Biology, 05.05.2020 07:12

Mathematics, 05.05.2020 07:12

Mathematics, 05.05.2020 07:13

Geography, 05.05.2020 07:13