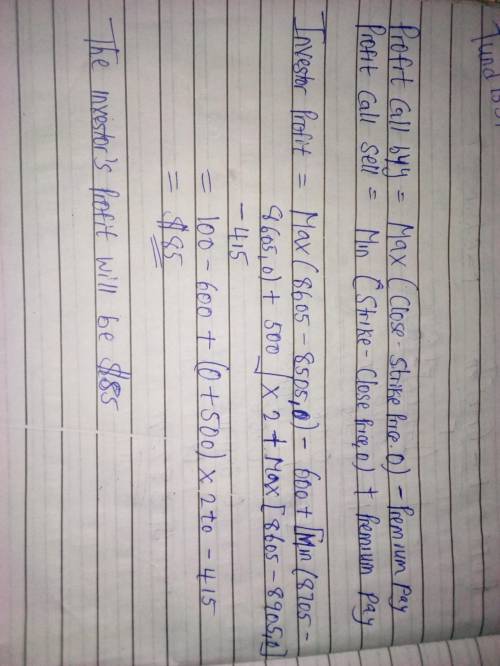

A one-month European call option on Bitcoin is with the strike price of $8,505, $8,705, and $8,905 are trading at $600, $500, and $415, respectively. An investor implements a butterfly spread (i. e., she buys one call with the strike price of $8,505, sells two calls with the strike price of $8,705, and buys one call with the strike price of $8,905. If at the maturity, the Bitcoin price is $8,605, what is the investor's profit

Answers: 2

Another question on Business

Business, 21.06.2019 20:40

Balances for each of the following accounts appear in an adjusted trial balance. identify each as an asset, liability, revenue, or expense. 1. accounts receivable 2. equipment 3. fees earned 4. insurance expense 5. prepaid advertising 6. prepaid rent 7. rent revenue 8. salary expense 9. salary payable 10. supplies 11. supplies expense 12. unearned rent

Answers: 3

Business, 21.06.2019 22:50

Which of the following statements is true? a job costing system will have a separate work in process account for each of the major processes. a process costing system will have a single work in process account. a process costing system will have a separate raw materials account for each of the major processes. a process costing system will have a separate work in process account for each of the major processes.

Answers: 3

Business, 21.06.2019 23:00

James has set the goal of achieving all "a"s during this year of school.which term best describes this goal

Answers: 2

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

You know the right answer?

A one-month European call option on Bitcoin is with the strike price of $8,505, $8,705, and $8,905 a...

Questions

Mathematics, 08.12.2021 18:40

History, 08.12.2021 18:40

Chemistry, 08.12.2021 18:40

English, 08.12.2021 18:40

Mathematics, 08.12.2021 18:40

SAT, 08.12.2021 18:40

Social Studies, 08.12.2021 18:40

Mathematics, 08.12.2021 18:40

Physics, 08.12.2021 18:40

Mathematics, 08.12.2021 18:40