Business, 07.06.2020 02:58 kellysmith45

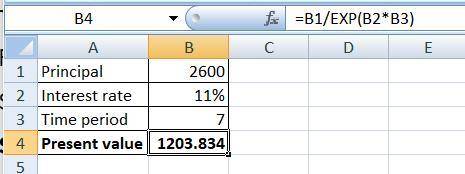

zero-coupon bond is a security that pays no interest, and is therefore bought at a substantial discount from its face value. If stated interest rates are 11% annually (with continuous compounding) how much would you pay today for a zero-coupon bond with a face value of $2,600 that matures in 7 years

Answers: 1

Another question on Business

Business, 21.06.2019 22:40

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 23.06.2019 01:30

Determine allison's december 31, 2018, investment in mathias balance.

Answers: 2

Business, 23.06.2019 02:00

Here are the expected cash flows for three projects: cash flows (dollars) project year: 0 1 2 3 4 a − 6,100 + 1,275 + 1,275 + 3,550 0 b − 2,100 0 + 2,100 + 2,550 + 3,550 c − 6,100 + 1,275 + 1,275 + 3,550 + 5,550 a. what is the payback period on each of the projects? b. if you use a cutoff period of 2 years, which projects would you accept?

Answers: 2

You know the right answer?

zero-coupon bond is a security that pays no interest, and is therefore bought at a substantial disco...

Questions

Mathematics, 02.11.2020 16:40

Mathematics, 02.11.2020 16:40

Mathematics, 02.11.2020 16:40

Mathematics, 02.11.2020 16:40

World Languages, 02.11.2020 16:40