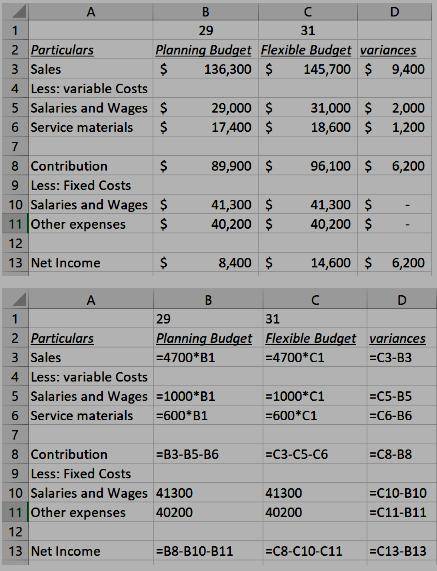

Cosden Corporation is an oil well service company that measures its output by the number of wells serviced. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes. Fixed cost per month Variable cost per wellRevenue $4,700Salaries and Wages $41,300 $1,000Service Materials $600Other Expenses $40,200When the company prepared its planning budget at the beginning of May, it assumed that 29 wells would have been serviced. However, 31 wells were actually serviced during May. Prepare the Planning Budget, Flexible Budget and variance analysis for Cosden Corporation.

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

Which of the following statements accurately describes how costs and benefits are calculated?

Answers: 1

Business, 22.06.2019 14:30

United continental holdings, inc., (ual), operates passenger service throughout the world. the following data (in millions) were adapted from a recent financial statement of united. sales (revenue) $38,901 average property, plant, and equipment 17,219 average intangible assets 8,883 1. compute the asset turnover. round your answer to two decimal places.

Answers: 2

Business, 22.06.2019 19:30

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Business, 22.06.2019 20:10

Mikkelson corporation's stock had a required return of 12.50% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. then an increase in investor risk aversion caused the market risk premium to rise by 2%. the risk-free rate and the firm's beta remain unchanged. what is the company's new required rate of return? (hint: first calculate the beta, then find the required return.) do not round your intermediate calculations.

Answers: 2

You know the right answer?

Cosden Corporation is an oil well service company that measures its output by the number of wells se...

Questions

History, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30

Biology, 30.08.2019 08:30

Social Studies, 30.08.2019 08:30

Business, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30

Computers and Technology, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30

Mathematics, 30.08.2019 08:30