Answers: 1

Another question on Business

Business, 22.06.2019 20:30

Exercise 7-7 martinez company reports the following financial information before adjustments. dr. cr. accounts receivable $168,900 allowance for doubtful accounts $3,200 sales revenue (all on credit) 849,300 sales returns and allowances 50,440 prepare the journal entry to record bad debt expense assuming martinez company estimates bad debts at (a) 4% of accounts receivable and (b) 4% of accounts receivable but allowance for doubtful accounts had a $1,550 debit balance. (if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

Answers: 3

Business, 22.06.2019 20:50

Swathmore clothing corporation grants its customers 30 days' credit. the company uses the allowance method for its uncollectible accounts receivable. during the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. at the fiscal year-end of december 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. at the end of 2012, accounts receivable were dollar 586.000 and the allowance account had a credit balance of dollar 50,000. accounts receivable activity for 2013 was as follows: the company's controller prepared the following aging summary of year-end accounts receivable: prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. (if no entry is required for a particular event, select "no journal entry required" in the first account field.) prepare the necessary year-end adjusting entry for bad debt expense. (if no entry is required for an event, select "no journal entry required" in the first account field.) what is total bad debt expense for 2013? calculate the amount of accounts receivable that would appear in the 2013 balance sheet?

Answers: 2

Business, 23.06.2019 00:30

Kim davis is in the 40 percent personal tax bracket. she is considering investing in hca(taxable) bonds that carry a 12 percent interest rate. what is her after- tax yield(interest rate) on the bonds?

Answers: 1

Business, 23.06.2019 02:10

Which of the following best describes what production accomplishes? a. efficient use of natural resources. b. a reduction in the size of the labor force. c. an increase in supply that lowers prices. d. value added to resources that already exist.

Answers: 1

You know the right answer?

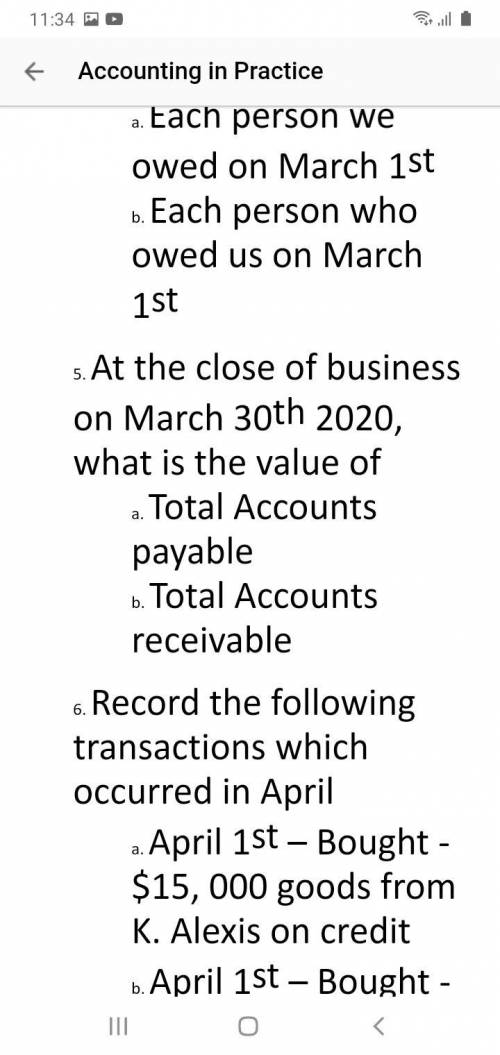

Please do not answer the question before on my profile because it is the wrong questions, but am goi...

Questions

Mathematics, 24.02.2021 16:40

Mathematics, 24.02.2021 16:40

English, 24.02.2021 16:40

Mathematics, 24.02.2021 16:40

Mathematics, 24.02.2021 16:40

Mathematics, 24.02.2021 16:40

Biology, 24.02.2021 16:40

Mathematics, 24.02.2021 16:40

Chemistry, 24.02.2021 16:40

Mathematics, 24.02.2021 16:40

Chemistry, 24.02.2021 16:40

Chemistry, 24.02.2021 16:40