Charles Schwab Corporation is one of the more innovative brokerage and financial service companies in the United States. The company recently provided information about its major business segments as follows (in millions):

Investor Services Institutional Services

Revenues $3,016 $1,523

Income from operations 847 523

Depreciation 133 54

A. How does a brokerage company like Schwab define the "Investor Services" and "Institutional Services" segments? Use the Internet to develop your answer

The segment serves the retail customer, you and me. These are the brokerage, Internet, and mutual fund services used by individual investors. The segment includes the same services provided for financial institutions, such as banks, mutual fund managers, insurance companies, and pension plan administrators

B. Provide a specific example of a variable and fixed cost in the "Investor Services" segment.

Variable costs in the "Investor Services" segment include: Check all that apply.

Depreciation on brokerage office equipment, such as computers and computer networks

Depreciation on brokerage offices

Property taxes on brokerage offices

Commissions to brokers

Fees paid to exchanges for executing trades

Transaction fees incurred by Schwab mutual funds to purchase and sell shares

Fixed costs in the "Investor Services" segment include: Check all that apply.

Depreciation on brokerage office equipment, such as computers and computer networks

Commissions to brokers

Property taxes on brokerage offices

Depreciation on brokerage offices

Fees paid to exchanges for executing trades

Transaction fees incurred by Schwab mutual funds to purchase and sell shares

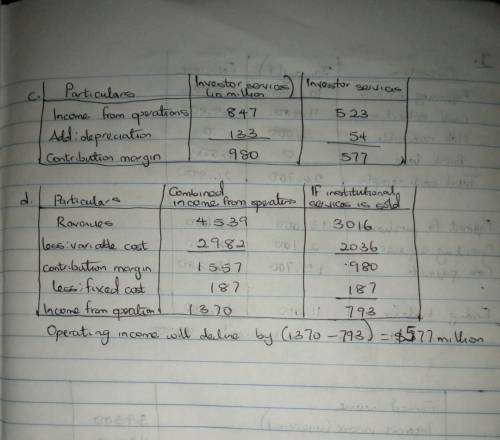

C. Estimate the contribution margin (in millions) for each segment, assuming depreciation represents the majority of fixed costs.

Investor Services Institutional Services

Estimated contribution margin $ $

D. If Schwab decided to sell its "Institutional Services" accounts to another company, estimate how much operating income would decline (in millions). $

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

Peninsula products has just applied for a loan at your bank. when reviewing peninsula's books for the year that just ended, you notice that the firm uses the fair value option for its bonds payable. you also see that the firm recorded a $55,000 debit in its bonds payable account and a $55,000 credit in its unrealized holding gain or loss"income account. over that same period, interest rates decreased by about 0.5 percent. how should this information affect the bank's decision as to whether to grant peninsula a loan? a : the bank should strongly consider giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen an increase in its credit rating over the past year. b : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely the result of the rise in interest rates. c : the bank should hesitate before giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen a decline in its credit rating over the past year. d : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely unrelated to either interest rates or the firm's credit rating.

Answers: 2

Business, 22.06.2019 02:00

On january 1, 2017, fisher corporation purchased 40 percent (90,000 shares) of the common stock of bowden, inc. for $980,000 in cash and began to use the equity method for the investment. the price paid represented a $48,000 payment in excess of the book value of fisher's share of bowden's underlying net assets. fisher was willing to make this extra payment because of a recently developed patent held by bowden with a 15-year remaining life. all other assets were considered appropriately valued on bowden's books. bowden declares and pays a $90,000 cash dividend to its stockholders each year on september 15. bowden reported net income of $400,000 in 2017 and $348,000 in 2018. each income figure was earned evenly throughout its respective year. on july 1, 2018, fisher sold 10 percent (22,500 shares) of bowden's outstanding shares for $338,000 in cash. although it sold this interest, fisher maintained the ability to significantly influence bowden's decision-making process. prepare the journal entries for fisher for the years of 2017 and 2018. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field. do not round intermediate calculations. round your final answers to the nearest whole dollar.)

Answers: 3

Business, 22.06.2019 07:30

Most states have licensing registration requirements for child care centers and family daycare homes. these usually include minimum standard for operation. which of the following would you most likely find required in a statement of state licensing standards for child care centers?

Answers: 2

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

You know the right answer?

Charles Schwab Corporation is one of the more innovative brokerage and financial service companies i...

Questions

Mathematics, 21.05.2020 04:08

History, 21.05.2020 04:09

Mathematics, 21.05.2020 04:09

Mathematics, 21.05.2020 04:09

History, 21.05.2020 04:09

Mathematics, 21.05.2020 04:09

Mathematics, 21.05.2020 04:09

English, 21.05.2020 04:09

Mathematics, 21.05.2020 04:09

History, 21.05.2020 04:09

Mathematics, 21.05.2020 04:09