Business, 13.06.2020 22:57 miafluellen

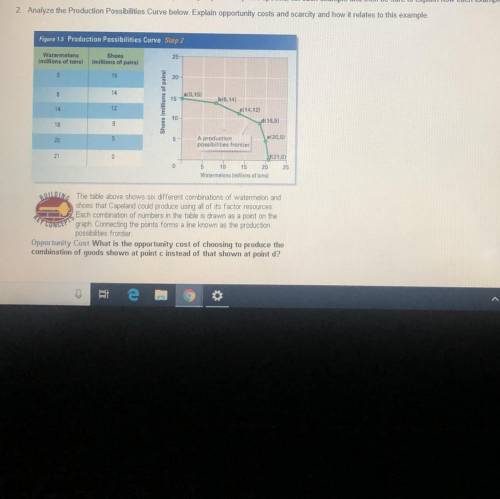

Analyze the Production Possibilities Curve below. Explain opportunity costs and scarcity and how it relates to this example

Figure 1.5 Production Possibilities Curve Sis2

Watermelons

lions of tons

25

Shoes

millions of pales

15

20

3

14

10.15)

Shoes (millions of pairal

15

b18,14)

14

12

114,12

10

18

d118,9)

120,51

A production

possibilities frontier

22

121,0

10 1

20 25

Wistermelons millions of tons)

Answers: 2

Another question on Business

Business, 22.06.2019 09:00

Brian has been working for a few years now and has saved a substantial amount of money. he now wants to invest 50 percent of his savings in a bank account where it will be locked for three years and gain interest. which type of bank account should brian open? a. savings account b. money market account c. checking account d. certificate of deposit

Answers: 1

Business, 22.06.2019 15:10

Popeye produces 20 cans of spinach in 8 hours. wimpy produces 15 hamburgers in 10 hours. if each hamburger trades for 1.5 cans of spinach, then: a.wimpy’s production and productivity are greater than popeye’s. b.popeye’s production is greater than wimpy’s, but his productivity is less. c.wimpy’s production is greater than popeye’s, but his productivity is less. d.popeye’s production and productivity are greater than wimpy’s.

Answers: 3

Business, 22.06.2019 17:00

Zeta corporation is a manufacturer of sports caps, which require soft fabric. the standards for each cap allow 2.00 yards of soft fabric, at a cost of $2.00 per yard. during the month of january, the company purchased 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. what is zeta corporation's materials price variance for the month of january?

Answers: 2

Business, 22.06.2019 20:00

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

You know the right answer?

Analyze the Production Possibilities Curve below. Explain opportunity costs and scarcity and how it...

Questions

Mathematics, 17.11.2020 22:30

Mathematics, 17.11.2020 22:30

English, 17.11.2020 22:30

Advanced Placement (AP), 17.11.2020 22:30

Mathematics, 17.11.2020 22:30

Arts, 17.11.2020 22:30

Mathematics, 17.11.2020 22:30

Engineering, 17.11.2020 22:30