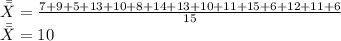

The Money Pit Mortgage Company is interested in monitoring the performance of the mortgage process. Fifteen samples of five completed mortgage transactions each were taken during a period when the process was believed to be in control. The times to complete the transactions were measured. The Money Pit Mortgage Company made some changes to the process and undertook a process capability study. The following data were obtained for 15 samples of size 5. Based on the individual observations, management estimated the process standard deviation to be 4.85 (days) for use in the process capability analysis. The lower and upper specification limits (in days) for the mortgage process times were 4 and 22.

Sample 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Mean 7 9 5 13 10 8 14 13 10 11 15 6 12 11 6

Range 8 12 3 10 9 7 7 14 13 10 5 5 11 9 10

Calculate the process capability index and the process capability ratio values?

Answers: 1

Another question on Business

Business, 21.06.2019 18:50

Which of the following is not a potential problem with beta and its estimation? sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the "true" or "expected future" beta. the beta of "the market," can change over time, sometimes drastically.

Answers: 3

Business, 21.06.2019 23:30

Renaldo scanlon is a financial consultant. he earns $30 per hour and works 32.5 hours a week. what is his straight-time pay?

Answers: 1

Business, 22.06.2019 05:00

You are chairman of the board of a successful technology firm. there is a nominal federal corporate tax rate of 35 percent, yet the effective tax rate of the typical corporation is about 12.6%. your firm has been clever with use of transfer pricing and keeping money abroad and has barely paid any taxes over the last 5 years; during this same time period, profits were $28 billion. one member of the board feels that it is un-american to use various accounting strategies in order to avoid paying taxes. others feel that these are legal loopholes and corporations have a fiduciary responsibility to minimize taxes. one board member quoted what the ceo of exxon once said: “i’m not a u.s. company and i don’t make decisions based on what’s good for the u.s.” what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 2

Business, 22.06.2019 14:50

The following information is needed to reconcile the cash balance for gourmet catering services. * a deposit of $5,600 is in transit. * outstanding checks total $1,000. * the book balance is $6,400 at february 28, 2019. * the bookkeeper recorded a $1,800 check as $17,200 in payment of the current month's rent. * the bank balance at february 28, 2019 was $17,410. * a deposit of $400 was credited by the bank for $4,000. * a customer's check for $3,300 was returned for nonsufficient funds. * the bank service charge is $90. what was the adjusted book balance?

Answers: 1

You know the right answer?

The Money Pit Mortgage Company is interested in monitoring the performance of the mortgage process....

Questions

Mathematics, 24.02.2021 17:30

History, 24.02.2021 17:30

Mathematics, 24.02.2021 17:30

Mathematics, 24.02.2021 17:30

Mathematics, 24.02.2021 17:30

Biology, 24.02.2021 17:30

Biology, 24.02.2021 17:30

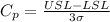

is given by the formula:

is given by the formula:![C_{pk} = min[\frac{\bar{\bar{X}} - LSL}{3 \sigma} , \frac{USL - \bar{\bar{X}} }{3 \sigma}]](/tpl/images/0688/6626/3085c.png)

![C_{pk} = min[\frac{\bar{\bar{X}} - LSL}{3 \sigma} , \frac{USL - \bar{\bar{X}} }{3 \sigma}]\\C_{pk} = min[\frac{10 - 4}{3 * 4.85} , \frac{22 - 4 }{3 *4.85}]\\C_{pk} = min[0.412, 0.825]\\C_{pk} = 0.412](/tpl/images/0688/6626/cd5cc.png)