Business, 18.06.2020 23:57 Ayyyyeeeeeeewuzgud

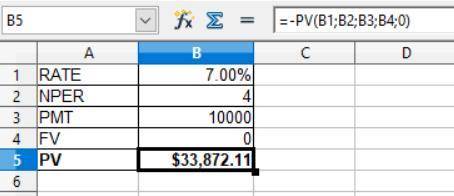

Your parents have accumulated a $120,000 nest egg. They have been planning to use this money to pay college costs to be incurred by you and your sister, Courtney. However, Courtney has decided to forgo college and start a nail salon. Your parents are giving Courtney $33,000 to help her get started, and they have decided to take year-end vacations costing $10,000 per year for the next four years. Use 7 percent as the appropriate interest rate throughout this problem. Use Appendix A and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

a. How much money will your parents have at the end of four years to help you with graduate school, which you will start then?

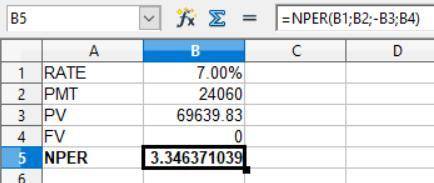

b. You plan to work on a master’s and perhaps a PhD. If graduate school costs $24,060 per year, approximately how long will you be able to stay in school based on these funds? (Round your final answer to 2 decimal places.)

Answers: 1

Another question on Business

Business, 22.06.2019 05:50

Acompany that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. prior to buying the new equipment, the company used 6 workers, who produced an average of 79 carts per hour. workers receive $16 per hour, and machine coast was $49 per hour. with the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $11 per hour while output increased by four carts per hour. a) compute the multifactor productivity (mfp) (labor plus equipment) under the prior to buying the new equipment. the mfp (carts/$) = (round to 4 decimal places). b) compute the productivity changes between the prior to and after buying the new equipment. the productivity growth = % (round to 2 decimal places)

Answers: 3

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

Business, 22.06.2019 21:10

An investor purchases 500 shares of nevada industries common stock for $22.00 per share today. at t = 1 year, this investor receives a $0.42 per share dividend (which is not reinvested) on the 500 shares and purchases an additional 500 shares for $24.75 per share. at t = 2 years, he receives another $0.42 (not reinvested) per share dividend on 1,000 shares and purchases 600 more shares for $31.25 per share. at t = 3 years, he sells 1,000 of the shares for $35.50 per share and the remaining 600 shares at $36.00 per share, but receives no dividends. assuming no commissions or taxes, the money-weighted rate of return received on this investment is closest to:

Answers: 3

Business, 23.06.2019 08:10

Suppose that in the year 2020 the price level in the fictional country of demet is 100, and the governement is considering

Answers: 2

You know the right answer?

Your parents have accumulated a $120,000 nest egg. They have been planning to use this money to pay...

Questions

Biology, 14.09.2020 14:01

Social Studies, 14.09.2020 14:01

History, 14.09.2020 14:01

Social Studies, 14.09.2020 14:01

Mathematics, 14.09.2020 14:01

Biology, 14.09.2020 14:01

History, 14.09.2020 14:01

Mathematics, 14.09.2020 14:01

Chemistry, 14.09.2020 14:01

Mathematics, 14.09.2020 14:01

History, 14.09.2020 14:01

English, 14.09.2020 14:01

Spanish, 14.09.2020 14:01

Social Studies, 14.09.2020 14:01

English, 14.09.2020 14:01

Mathematics, 14.09.2020 14:01

Mathematics, 14.09.2020 14:01

Mathematics, 14.09.2020 14:01

Mathematics, 14.09.2020 14:01

Biology, 14.09.2020 14:01