Business, 19.06.2020 14:57 batmanmarie2004

Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted information or the year is as follows:

Activity Cost Driver Amount of Driver

Materials handling $72,000 Number of moves 3,000

Engineering 165,000 Number of change orders 10,000

Other overhead 280,000 Direct labor hours 50,000

Heitger worked on four jobs in July. Data are as follows:

Job 13-43 Job 13-44 Job 13-45 Job 13-46

Beginning balance $20,300 $19,800 $2,300 $0

Direct materials $6,500 $8,900 $12,700 $9,800

Direct labor cost $18,000 $20,000 $32,000 $2,400

Number of moves 44 52 29 5

Number of change orders 30 40 20 20

Direct labor hours 900 1,000 1,600 120

By July 31, Jobs 13-43 and 13-44 were completed and sold. Jobs 13-45 and 13-46 were still in process.

Required:

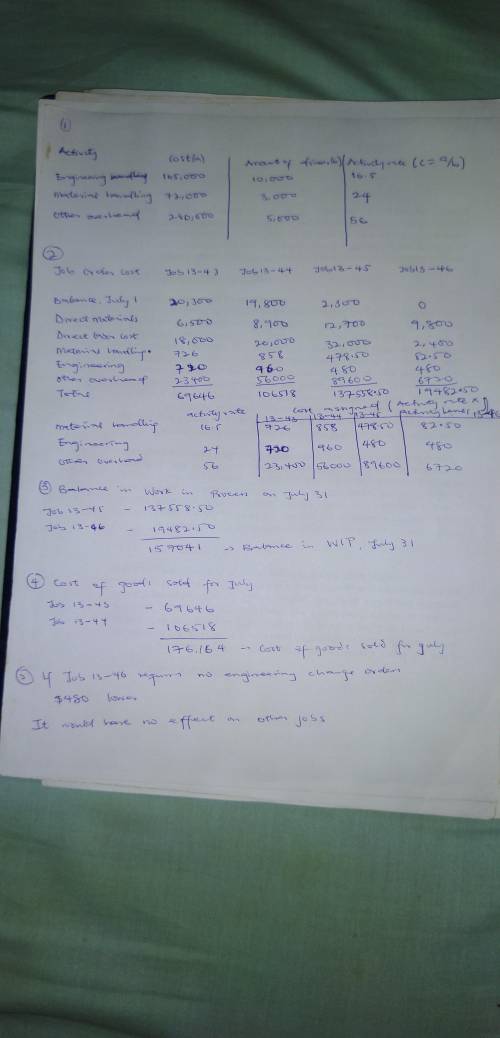

1. Calculate the activity rates for each of the three overhead activities.

2. Prepare job-order cost sheets for each job showing all costs through July 31.

3. Calculate the balance in Work in Process on July 31.

4. Calculate the cost of goods sold for July.

5. What if Job 13-46 required no engineering change orders? What is the new cost of Job 13-46? How would the cost of other jobs be affected?

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Joe finally found a house for sale that he liked. which factor could increase the price of the house he likes? a. both he and the seller each have a real estate agent. b. a home inspector finds faulty wiring in the house. c. the house has been for sale for almost a year. d. several buyers all want that same house.

Answers: 2

Business, 22.06.2019 08:00

3. describe the purpose of the sec. (1-4 sentences. 2.0 points)

Answers: 3

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 1

Business, 22.06.2019 11:40

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

You know the right answer?

Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jo...

Questions

History, 18.11.2020 22:10

Mathematics, 18.11.2020 22:10

SAT, 18.11.2020 22:10

Mathematics, 18.11.2020 22:10

Spanish, 18.11.2020 22:10

Mathematics, 18.11.2020 22:10

Geography, 18.11.2020 22:10

Social Studies, 18.11.2020 22:10

Health, 18.11.2020 22:10

Mathematics, 18.11.2020 22:10