Business, 28.06.2020 01:01 maheshwarlall

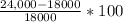

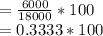

A company reported $18,000.00 of net income for 20X6, $24,000.00 for 20X7, and $26,000.00 for 20X8. The percentage change in net income from 20X6 to 20X7 was A. 8.33 percent. B. 30.00 percent.

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense. accounts receivable $ 435,000 debit allowance for doubtful accounts 1,250 debit net sales 2,100,000 credit all sales are made on credit. based on past experience, the company estimates 1.0% of credit sales to be uncollectible. what adjusting entry should the company make at the end of the current year to record its estimated bad debts expense

Answers: 2

Business, 22.06.2019 22:00

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

Business, 23.06.2019 00:50

Mr. drucker uses a periodic review system to manage the inventory in his dry goods store. he likes to maintain 15 sacks of sugar on his shelves based on the annual demand figure of 225 sacks. it costs $2 to place an order for sugar and costs $1 to hold a sack in inventory for a year. mr. drucker checks inventory one day and notes that he is down to 9 sacks; how much should he order?

Answers: 1

Business, 23.06.2019 00:50

On january 1 of the current year, jimmy's sandwich company reported owner's capital totaling $128,000. during the current year, total revenues were $106,000 while total expenses were $95,500. also, during the current year jimmy withdrew $30,000 from the company. no other changes in equity occurred during the year. if, on december 31 of the current year, total assets are $206,000, the change in owner's capital during the year was:

Answers: 3

You know the right answer?

A company reported $18,000.00 of net income for 20X6, $24,000.00 for 20X7, and $26,000.00 for 20X8....

Questions

English, 07.04.2021 18:20

Mathematics, 07.04.2021 18:20

Mathematics, 07.04.2021 18:20

Biology, 07.04.2021 18:20

Biology, 07.04.2021 18:20

Social Studies, 07.04.2021 18:20

Mathematics, 07.04.2021 18:20

Biology, 07.04.2021 18:20

Mathematics, 07.04.2021 18:20

English, 07.04.2021 18:30

English, 07.04.2021 18:30

Geography, 07.04.2021 18:30

Mathematics, 07.04.2021 18:30