Business, 28.06.2020 03:01 livingfamyboys35

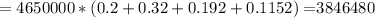

An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $4,650,000 and will be sold for $1,325,000 at the end of the project. If the tax rate is 22 percent, what is the aftertax salvage value of the asset

Answers: 1

Another question on Business

Business, 22.06.2019 03:10

On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. journalize the first interest payment and the amortization of the related bond premium. round to the nearest dollar. if an amount box does not require an entry, leave it blank.

Answers: 3

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 15:40

The cost of direct labor used in production is recorded as a? a. credit to work-in-process inventory account. b. credit to wages payable. c. credit to manufacturing overhead account. d. credit to wages expense.

Answers: 2

Business, 22.06.2019 20:30

Afirm wants to strengthen its financial position. which of the following actions would increase its current ratio? a. reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and equipment.b. use cash to repurchase some of the company's own stock.c. borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year.d. issue new stock, then use some of the proceeds to purchase additional inventory and hold the remainder as cash.e. use cash to increase inventory holdings.

Answers: 3

You know the right answer?

An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset...

Questions

Mathematics, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Social Studies, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

English, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

English, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Chemistry, 04.03.2021 21:00