Business, 28.06.2020 06:01 krystalsanabria83

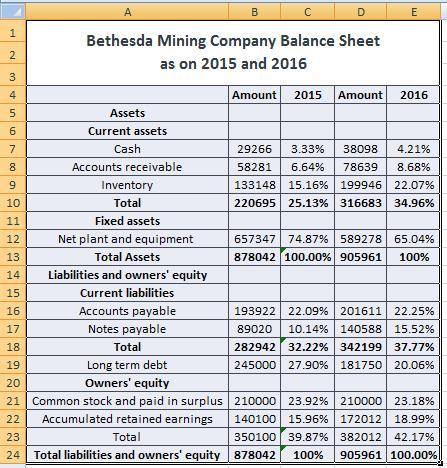

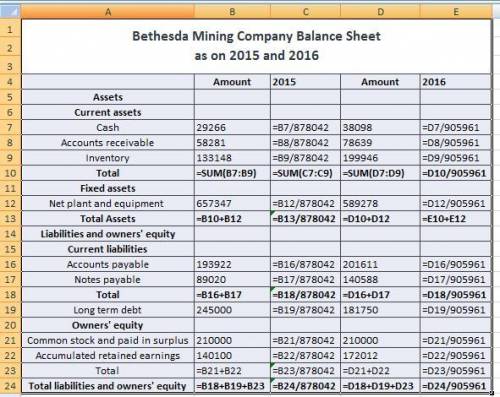

Bethesda Mining Company reports the following balance sheet information for 2015 and 2016.

Prepare the 2015 and 2016 common-size balance sheets for Bethesda Mining. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

BETHESDA MINING COMPANY

Balance Sheets as of December 31, 2015 and 2016

2015 2016 2015 2016

Assets Liabilities and Owners’ Equity

Current assets Current liabilities

Cash $ 29,266 % $ 38,098 % Accounts payable $ 193,922 % $ 201,611 %

Accounts receivable 58,281 % 78,639 % Notes payable 89,020 % 140,588 %

Inventory 133,148 % 199,946 % Total $ 282,942 % $ 342,199 %

Total $ 220,695 % $ 316,683 % Long-term debt $ 245,000 % $ 181,750 %

Owners’ equity

Common stock and paid-in surplus $ 210,000 % $ 210,000 %

Fixed assets Accumulated retained earnings 140,100 % 172,012 %

Net plant and equipment $ 657,347 % $ 589,278 % Total $ 350,100 % $ 382,012 %

Total assets $ 878,042 % $ 905,961 % Total liabilities and owners’ equity $ 878,042 % $ 905,961 %

Answers: 3

Another question on Business

Business, 22.06.2019 05:00

Every 10 years, the federal government sponsors a national survey of health and health practices (nhanes). one question in the survey asks participants to rate their overall health using a 5-point rating scale. what is the scale of measurement used for this question? ratio ordinal interval nominal

Answers: 1

Business, 22.06.2019 12:00

Describe the three different ways the argument section of a cover letter can be formatted

Answers: 1

Business, 22.06.2019 19:00

Describe how to write a main idea expressed as a bottom-line statement

Answers: 3

Business, 23.06.2019 00:30

Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 20 years. assume you purchase a bond that costs $25. a. what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. if you purchased the bond for $25 in 2017 at the then current interest rate of .27 percent year, how much would the bond be worth in 2027? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. in 2027, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2037. what annual rate of return will you earn over the last 10 years? (do not

Answers: 3

You know the right answer?

Bethesda Mining Company reports the following balance sheet information for 2015 and 2016.

Prepare...

Questions

Mathematics, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20

History, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20

Social Studies, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20

Mathematics, 25.02.2021 19:20