An owner of a large ranch is considering the purchase of a tractor with a front-end loader to clean his corrals instead of hiring workers that do it with a pitch fork. He has given you the following information and has asked you to evaluate this investment. The equipment costs $40,000. The rancher expects that he will save $11,500 a year that is usually paid to workers that clean out the corral by hand. However, he will incur an additional cost of $1,000 for fuel, repairs and maintenance. The rancher plans on keeping the equipment for 3 years before replacing it with a new one. He thinks he can sell the old equipment for $25,000 in three years. The rancher anticipates that his marginal tax rate will be 20 percent over the next three years. The IRS will allow the rancher to depreciate the tractor over seven yearsusing the straight-line method. The rancher requires at least a 15% pretax rate of return on capital (pretax).

1. What is the annual after-tax Net Returns?

A. 11,500

B. 9,200

C. 10,500

D. 8,400

E. None of the Above

2. What is the tax savings from depreciation?

A. 5,714

B. 40,000

C. 1,143

D. 2,667

E. None of the above

3. What is the after- tax terminal value in three years?

A. 24,571

B. 25,000

C. 40,000

D. 17,145

E. none of the above

4. What is the accumulated depreciation over the three years?

A. 5,715

B. 40,000

C. 8,000

D. 17,145

E. none of the above

5. What is the after- tax discount rate?

A. 15%

B. 12%

C. 3%

D 10%

E. None of the above

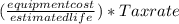

6. What is the present value of the after- tax net returns?

A. 40,000

B. 410

C. 17,489

D. 2,755

E. 20,175

F. None of the above

7. What is the present value tax savings from depreciation?

A. 40,000

B. 410

C. 17,489

D. 2,755

E. 20,175

F. None of the above

8. What is the present value of the after- tax terminal value?

A. 40,000

B. 410

C. 17,489

D. 2,755

E. 20,175

F. None of the above

9. What is the Net Present Value?

A. 40,000

B. 410

C. 17,489

D. 2,755

E. 20,175

F. none of the above

10. What is the maximum fuel, repairs and maintenancecost that can be paid each year to operate the loader and still find this investment profitable?

A. 1,213

B. 10,287

C. 11,500

D. 867

E. None of the above

Answers: 3

Another question on Business

Business, 21.06.2019 18:00

Employers hiring for entry-level positions in hospitality and tourism expect workers to

Answers: 3

Business, 22.06.2019 10:40

At cooly cola, we are testing the appeal of our new diet one cola. in a taste test of 250 randomly chosen cola drinkers, 200 consumers preferred diet one cola to the leading brand. assuming that the sample were large enough, the large-sample 95% confidence interval for the population proportion of cola drinkers that prefer diet one cola would be:

Answers: 1

Business, 22.06.2019 11:40

Select the correct answer. which is a benefit of planning for your future career? a.being less prepared after high school. b.having higher tuition in college. c.earning college credits in high school. d.ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 20:20

Digitalhealth electronics inc. is a company that builds diagnostic devices. it was the first company to develop a compact mri scanner by reconfiguring the components of the mri technology. this smaller and user-friendly version of the huge mri scanner created demand from small hospitals, nursing homes, and private practice doctors who were earlier dependent on the scanning machines in large hospitals. which of the following types of innovations does this scenario best illustrate? a. disruptive innovation b. incremental innovation c. radical innovation d. architectural innovation

Answers: 3

You know the right answer?

An owner of a large ranch is considering the purchase of a tractor with a front-end loader to clean...

Questions

Mathematics, 28.07.2021 06:40

Mathematics, 28.07.2021 06:40

Mathematics, 28.07.2021 06:40

Physics, 28.07.2021 06:40

History, 28.07.2021 06:40

Mathematics, 28.07.2021 06:40

History, 28.07.2021 06:40

Mathematics, 28.07.2021 06:40

Computers and Technology, 28.07.2021 06:40

= 10500 - (40000/7) = $4785.71

= 10500 - (40000/7) = $4785.71