Business, 04.07.2020 01:01 lailabirdiemae

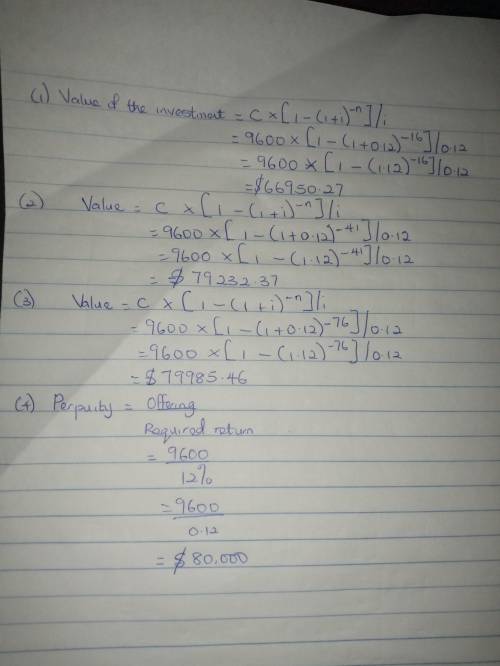

An investment offers $9,600 per year for 16 years, with the first payment occurring 1 year from now. Assume the required return is 12 percent.

Requirement 1:

What is the value of the investment? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Requirement 2:

What would the value be if the payments occurred for 41 years? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Requirement 3:

What would the value be if the payments occurred for 76 years? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Requirement 4:

What would the value be if the payments occurred forever? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 14:30

crow design, inc. is a web site design and consulting firm. the firm uses a job order costing system in which each client is a different job. crow design assigns direct labor, licensing costs, and travel costs directly to each job. it allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. direct labor hours (professional) 6,250 hours direct labor costs ($1,800,000 support staff salaries ,000 computer ,000 office ,000 office ,000 in november 2012, crow design served several clients. records for two clients appear here: delicious treats mesilla chocolates direct labor 700 hours 100 hours software licensing $ 4,000 $400 travel costs 8,000 1. compute crow design’s direct labor rate and its predetermined indirect cost allocation rate for 2012. 2. compute the total cost of each job. 3. if simone wants to earn profits equal to 50% of service revenue, how much (what fee) should she charge each of these two clients? 4. why does crow design assign costs to jobs?

Answers: 2

Business, 22.06.2019 16:50

Identify and describe a variety of performance rating scales that can be used in organizations including graphical scales, letter scales, and numeric scales.

Answers: 2

Business, 22.06.2019 19:30

Kirnon clinic uses client-visits as its measure of activity. during july, the clinic budgeted for 3,250 client-visits, but its actual level of activity was 3,160 client-visits. the clinic has provided the following data concerning the formulas to be used in its budgeting: fixed element per month variable element per client-visitrevenue - $ 39.10personnel expenses $ 35,100 $ 10.30medical supplies 1,100 7.10occupancy expenses 8,100 1.10administrative expenses 5,100 0.20total expenses $ 49,400 $ 18.70the activity variance for net operating income in july would be closest to:

Answers: 1

You know the right answer?

An investment offers $9,600 per year for 16 years, with the first payment occurring 1 year from now....

Questions

Mathematics, 18.01.2021 20:30

Biology, 18.01.2021 20:30

Mathematics, 18.01.2021 20:30

Arts, 18.01.2021 20:30

Mathematics, 18.01.2021 20:30

Health, 18.01.2021 20:30

Biology, 18.01.2021 20:30

Mathematics, 18.01.2021 20:30

Mathematics, 18.01.2021 20:30

Mathematics, 18.01.2021 20:30

Biology, 18.01.2021 20:30

Spanish, 18.01.2021 20:30