Business, 07.07.2020 23:01 amandajennings01

Diamondback Welding & Fabrication Corporation sells and services pipe welding equipment in Illinois. The following selected accounts appear in the ledger of Diamondback Welding & Fabrication Corporation at the beginning of the current fiscal year:

Preferred 2% Stock, $80 par (100,000 shares authorized, 60,000 shares issued) $4,800,000

Paid-In Capital in Excess of Par—Preferred Stock 210,000

Common Stock, $9 par (3,000,000 shares authorized, 1,750,000 shares issued) 15,750,000

Paid-In Capital in Excess of Par—Common Stock 1,400,000

Retained Earnings 52,840,000

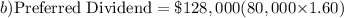

During the year, the corporation completed a number of transactions affecting the stockholders’ equity

The owners' equity in a corporation.

They are summarized as follows:

Feb. 2 Purchased 87,500 shares of treasury common for $8 per share.

Mar. 16 Sold 55,000 shares of treasury common for $11 per share.

May 7 Issued 20,000 shares of preferred 2% stock at $84.

Jun. 27 Issued 400,000 shares of common stock The stock outstanding when a corporation has issued only one class of stock at $13, receiving cash.

Aug. 30 Sold 18,000 shares of treasury common for $7.50 per share.

Dec. 5 Declared cash dividends.

A cash distribution of earnings by a corporation to its shareholders.

Of $1.60 per share on preferred stock

A class of stock with preferential rights over common stock.

and $0.05 per share on common stock.

31 Paid the cash dividends

Distributions of a corporation's earnings to stockholders.

Requried:

a. Journalize the entries to record the transactions.

Answers: 3

Another question on Business

Business, 22.06.2019 10:20

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 3

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

Business, 22.06.2019 11:30

Mai and chuck have been divorced since 2012. they have three boys, ages 6, 8, and 10. all of the boys live with mai and she receives child support from chuck. mai and chuck both work and the boys need child care before and after school. te boys attend the fun house day care center and mai paid them $2,000 and chuck paid them $3,000. mai's agi is $18,000 and chuck's is $29,000. mai will claim two of the boys as dependents. she signed form 8332 which allows chuck to claim one of the boys. who can take the child and dependent care credit?

Answers: 3

Business, 22.06.2019 18:30

Order these statements in the correct order to fill in the central idea and key points for a chronological speech. question 22 options: there are several steps that someone must take to become a doctor. finally, you will need to get a medical license, and become board certified in your specialty area. then, you must get admitted into to medical school and earn a medical degree. next, you will need to complete a residency. first you must earn a bachelors degree.

Answers: 2

You know the right answer?

Diamondback Welding & Fabrication Corporation sells and services pipe welding equipment in Illin...

Questions

History, 16.03.2020 18:23

Mathematics, 16.03.2020 18:23

History, 16.03.2020 18:23

Biology, 16.03.2020 18:23

History, 16.03.2020 18:24

Mathematics, 16.03.2020 18:24

Biology, 16.03.2020 18:24

Mathematics, 16.03.2020 18:24

Mathematics, 16.03.2020 18:24