Business, 14.07.2020 20:01 eduardavezdemel

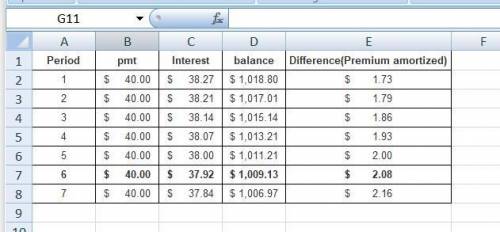

A 1000 par value 5-year bond with 8.0% semiannual coupons was bought to yield 7.5% convertible semiannually. Determine the amount of premium amortized in the 6th coupon payment.

Answers: 3

Another question on Business

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 19:30

One of the benefits of a well designed ergonomic work environment is low operating costs is true or false

Answers: 3

Business, 22.06.2019 22:00

Suppose that a paving company produces paved parking spaces (q) using a fixed quantity of land (t) and variable quantities of cement (c) and labor (l). the firm is currently paving 1,000 parking spaces. the firm's cost of cement is $3 comma 600.003,600.00 per acre covered (c) and its cost of labor is $35.0035.00/hour (w). for the quantities of c and l that the firm has chosen, mp subscript upper c baseline equals 60mpc=60 and mp subscript upper l baseline equals 7mpl=7. is this firm minimizing its cost of producing parking spaces?

Answers: 3

You know the right answer?

A 1000 par value 5-year bond with 8.0% semiannual coupons was bought to yield 7.5% convertible semia...

Questions

Physics, 17.09.2019 01:40

History, 17.09.2019 01:40

Mathematics, 17.09.2019 01:40

Mathematics, 17.09.2019 01:40

Business, 17.09.2019 01:40

English, 17.09.2019 01:40

Physics, 17.09.2019 01:40

Biology, 17.09.2019 01:40

English, 17.09.2019 01:40