Business, 15.07.2020 03:01 iiomqjessica

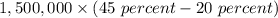

A city starts a solid waste landfill during 2017. When the landfill was opened the city estimated that it would fill to capacity within 5 years and that the cost to cover the facility would be $1.5 million which will not be paid until the facility is closed. At the end of 2017, the facility was 20% full, and at the end of 2018 the facility was 45% full. If the landfill is judged to be a governmental fund, what liability is reported on the fund financial statements at the end of 2018

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

Paar corporation bought 100 percent of kimmel, inc., on january 1, 2012. on that date, paar’s equipment (10-year life) has a book value of $420,000 but a fair value of $520,000. kimmel has equipment (10-year life) with a book value of $272,000 but a fair value of $400,000. paar uses the equity method to record its investment in kimmel. on december 31, 2014, paar has equipment with a book value of $294,000 but a fair value of $445,200. kimmel has equipment with a book value of $190,400 but a fair value of $357,000. the consolidated balance for the equipment account as of december 31, 2014 is $574,000. what would be the impact on consolidated balance for the equipment account as of december 31, 2014 if the parent had applied the initial value method rather than the equity method? the balance in the consolidated equipment account cannot be determined for the initial value method using the information given. the consolidated equipment account would have a higher reported balance. the consolidated equipment account would have a lower reported balance. no effect: the method the parent uses is for internal reporting purposes only and has no impact on consolidated totals.

Answers: 2

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 16:10

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 22.06.2019 18:00

If you would like to ask a question you will have to spend some points

Answers: 1

You know the right answer?

A city starts a solid waste landfill during 2017. When the landfill was opened the city estimated th...

Questions

Mathematics, 27.08.2021 18:40

Mathematics, 27.08.2021 18:40

Social Studies, 27.08.2021 18:40

Spanish, 27.08.2021 18:50

Mathematics, 27.08.2021 18:50

Mathematics, 27.08.2021 18:50