Business, 19.07.2020 01:01 pickelswolf5938

The following items were selected from among the transactions completed by O’Donnel Co. during the current year:

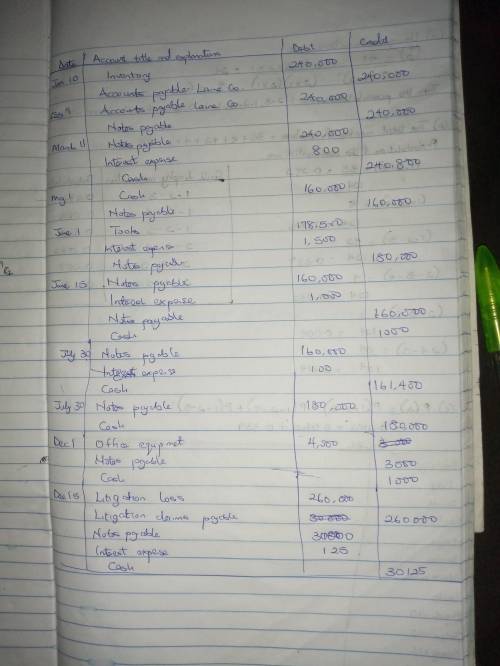

Jan. 10. Purchased merchandise on account from Laine Co., $240,000, terms n/30.

Feb. 9. Issued a 30-day, 4% note for $240,000 to Laine Co., on account.

Mar. 11. Paid Laine Co. the amount owed on the note of February 9.

May 1. Borrowed $160,000 from Tabata Bank, issuing a 45-day, 5% note.

June 1. Purchased tools by issuing a $180,000, 60-day note to Gibala Co., which discounted the note at the rate of 5%.

15. Paid Tabata Bank the interest due on the note of May 1 and renewed the loan by issuing a new 45-day, 7% note for $160,000. (Journalize both the debit and credit to the notes payable account.)

July 30. Paid Tabata Bank the amount due on the note of June 15.

30. Paid Gibala Co. the amount due on the note of June 1.

Dec. 1. Purchased office equipment from Warick Co. for $400,000, paying $100,000 and issuing a series of ten 5% notes for $30,000 each, coming due at 30-day intervals.

15. Settled a product liability lawsuit with a customer for $260,000, payable in January. O’Donnel accrued the loss in a litigation claims payable account.

31. Paid the amount due Warick Co. on the first note in the series issued on December 1.

Required:

a. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year.

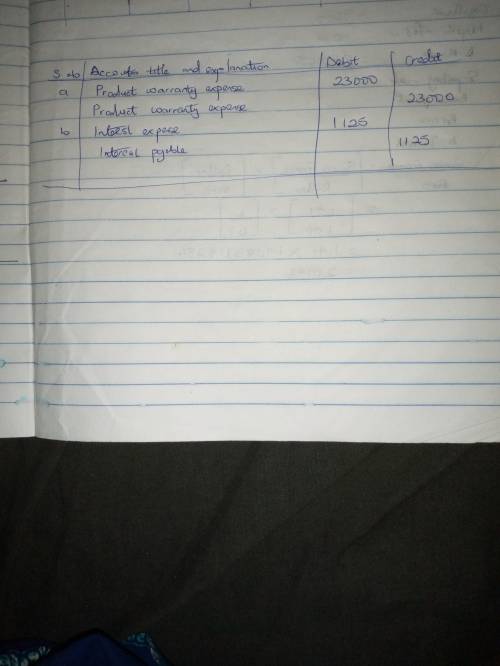

b. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):

1. Product warranty cost, $23,000.

2. Interest on the nine remaining notes owed to Warick Co. Assume a 360-day year.

Answers: 3

Another question on Business

Business, 21.06.2019 19:40

Uppose stanley's office supply purchases 50,000 boxes of pens every year. ordering costs are $100 per order and carrying costs are $0.40 per box. moreover, management has determined that the eoq is 5,000 boxes. the vendor now offers a quantity discount of $0.20 per box if the company buys pens in order sizes of 10,000 boxes. determine the before-tax benefit or loss of accepting the quantity discount. (assume the carrying cost remains at $0.40 per box whether or not the discount is taken.)

Answers: 1

Business, 22.06.2019 02:20

The following information is available for juno company for the month ending june 30, 2019. * balance as per the bank statement is $ 11 comma 000. * balance as per books is $ 10 comma 400. * check #506 for $ 1 comma 200 and check #510 for $ 900 were not shown on the june 30, bank statement. * a deposit in transit of $ 3 comma 346 had not been received by the bank when the bank statement was generated. * a bank debit memo indicated an nsf check for $ 70 written by jane smith to juno company on june 13. * a bank credit memo indicated a note collected by the bank of $ 1 comma 900 and interest revenue of $ 51 on june 20. * the bank statement indicated service charges of $ 35. what is the adjusted book balance?

Answers: 3

Business, 22.06.2019 04:30

Peyton taylor drew a map with scale 1 cm to 10 miles. on his map, the distance between silver city and golden canyon is 3.75 cm. what is the actual distance between silver city and golden canyon?

Answers: 3

Business, 22.06.2019 06:30

Select all that apply. what do opponents of minimum wage believe are the results of minimum wage? increases personal income results in job shortages causes unemployment raises prices of goods

Answers: 1

You know the right answer?

The following items were selected from among the transactions completed by O’Donnel Co. during the c...

Questions

Mathematics, 11.03.2021 08:50

Biology, 11.03.2021 08:50

Biology, 11.03.2021 08:50

Mathematics, 11.03.2021 08:50

Mathematics, 11.03.2021 08:50

English, 11.03.2021 08:50

History, 11.03.2021 08:50

Mathematics, 11.03.2021 08:50