Business, 21.07.2020 16:01 quinnmal023

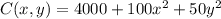

The cost of controlling emissions at a firm goes up rapidly as the amount of emissions reduced goes up. Here is a possible model:

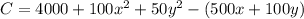

C(x, y)= 4000+100x^2+50y^2

where x is the reduction in sulfur emissions, y is the reduction in lead emissions (in pounds of pollutant per day), and C is the daily cost to the firm (in dollars) of this reduction. Government clean-air subsidies amount to $500 per pound of sulfur and $100 per pound of lead removed. How many pounds of pollutant should the firm remove each day in order to minimize net cost?

Answers: 2

Another question on Business

Business, 22.06.2019 10:10

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 22.06.2019 15:50

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

You know the right answer?

The cost of controlling emissions at a firm goes up rapidly as the amount of emissions reduced goes...

Questions

Physics, 10.09.2021 05:30

Biology, 10.09.2021 05:30

Mathematics, 10.09.2021 05:30

History, 10.09.2021 05:30

English, 10.09.2021 05:30

Biology, 10.09.2021 05:30

History, 10.09.2021 05:30

Mathematics, 10.09.2021 05:30

Mathematics, 10.09.2021 05:30

Mathematics, 10.09.2021 05:30

Mathematics, 10.09.2021 05:30

Chemistry, 10.09.2021 05:30

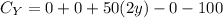

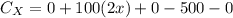

; by differentiating with respect to x alone;

; by differentiating with respect to x alone;

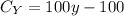

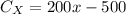

; by differentiating with respect to y alone;

; by differentiating with respect to y alone;