Business, 29.07.2020 18:01 webbskyler

Which one of the following statements is correct?

A. A portfolio variance is a weighted average of the variances of the individual securities which

comprise the portfolio.

B. A portfolio variance is dependent upon the portfolio;s asset allocation..

C. A portfolio variance is unaffected by the correlations between the individual securities held in

the portfolio.

D. The portfolio variance must be greater than the lowest variance of any of the securities held in

the portfolio.

E. The portfolio variance must be less than the lowest variance of any of the securities held in the

portfolio.

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

rural residential development company and suburban real estate corporation form a joint stock company. the longest duration a joint stock company can be formed for is

Answers: 2

Business, 22.06.2019 12:40

When cell phones were first entering the market, they were relatively large and reception was undependable. all cell phones were essentially the same. but as the technology developed, many competitors entered, introducing features unique to their phones. today, cell phones are only a small fraction of the size and weight of their predecessors. consumers can buy cell phones with color screens, cameras, internet access, daily planners, or voice activation (and any combination of these features). the history of the cell phone demonstrates what marketing trend?

Answers: 3

Business, 22.06.2019 13:30

Hundreds of a bank's customers have called the customer service call center to complain that they are receiving text messages on their phone telling them to access a website and enter personal information to resolve an issue with their account. what action should the bank take?

Answers: 2

Business, 22.06.2019 17:10

At the end of the current year, accounts receivable has a balance of $550,000; allowance for doubtful accounts has a credit balance of $5,500; and sales for the year total $2,500,000. an analysis of receivables estimates uncollectible receivables as $25,000. determine the net realizable value of accounts receivable after adjustment. (hint: determine the amount of the adjusting entry for bad debt expense and the adjusted balance of allowance of doubtful accounts.)

Answers: 3

You know the right answer?

Which one of the following statements is correct?

A. A portfolio variance is a weighted average of...

Questions

Mathematics, 09.12.2020 08:40

History, 09.12.2020 08:40

Mathematics, 09.12.2020 08:40

Mathematics, 09.12.2020 08:40

English, 09.12.2020 08:40

Mathematics, 09.12.2020 08:40

Chemistry, 09.12.2020 08:40

History, 09.12.2020 08:40

Mathematics, 09.12.2020 08:40

Biology, 09.12.2020 08:40

Biology, 09.12.2020 08:40

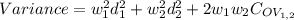

= the weight of the nth security.

= the weight of the nth security. = the variance of the nth security.

= the variance of the nth security. = the covariance of the two security.

= the covariance of the two security.